How to review timesheets & prepare invoices

This article talks about preparing invoices using a timesheet.

1. Introduction

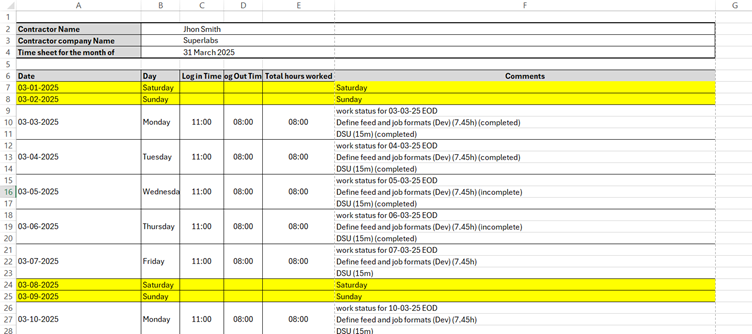

A timesheet is a structured document—typically in Excel or digital format—used to systematically track the number of hours a resource (employee or contractor) spends on assigned tasks or projects over a specific period (e.g., daily, weekly, or monthly). Timesheets are critical in determining work effort, calculating billable hours, and generating accurate invoices for client billing

2. Timesheet Structure and Creation

Each resource is allocated a dedicated Excel workbook, containing individual sheets for each month (e.g., "Jan 2025", "Feb 2025", etc.).

2.1. Timesheet Columns Description

Each monthly sheet must contain the following columns:

|

Column Name |

Description |

|

Date |

The calendar date of the working

day (e.g., 01-May-2025). |

|

Day |

The name of the weekday (e.g.,

Monday, Tuesday, etc.). |

|

Log In Time |

Time at which the resource

started work for the day. |

|

Log Out Time |

Time at which the resource

concluded work for the day. |

|

Total Hours Worked |

Computed as: Log Out Time −

Login Time (excluding unpaid breaks, if any). |

|

Comments |

Short description of work

performed that day (e.g., “Developed login module”). |

2.2. Non-Working Days

- Weekends: Saturdays and Sundays are considered non-working days by default.

- Leave Days: Public holidays and approved leaves (e.g., sick leave, casual leave) are also marked as non-working days. These should be appropriately annotated in the comments section (e.g., “Sick Leave – Paid”).

- Paid Leaves: If the company policy provides paid leave (e.g., paid sick leave), mark these days accordingly but exclude them from actual billable work hours unless otherwise agreed with the client.

3. Timesheet Review and Approval

- Daily/Weekly Monitoring: Project managers or HR personnel should review timesheets regularly to ensure accuracy and compliance.

- Verification Points: Confirm login/logout accuracy, match task descriptions with assigned duties, and verify working hours.

- Authorization: Timesheets must be signed off (digitally or physically) before proceeding to billing.

4. Invoice Calculation Sheet.

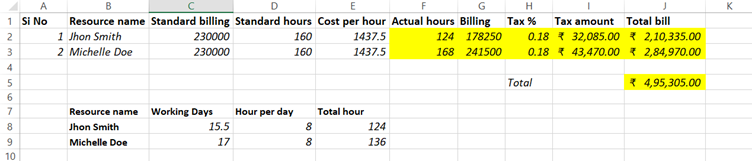

The invoice calculation is performed using a structured billing table derived from employee timesheets. This sheet typically comprises two main tables:

4.1. Table 1: Billing Summary Per Resource

|

Column Name |

Description |

||

|

Serial No |

|

||

|

Resource

Name |

Full name of

the resource/contractor. |

||

|

Standard

Billing |

Agreed

billing amount for the full standard work month. |

||

|

Standard

Work Hours |

Total

expected work hours for the month (e.g., 160 hours). |

||

|

Cost Per

Hour |

Derived as:

Standard Billing / Standard Work Hours. |

||

|

Actual

Work Hours |

Total number

of hours worked as per the approved timesheet. |

||

|

Billing

Amount |

Actual Work

Hours × Cost Per Hour |

||

|

Tax |

Tax

calculated based on applicable GST structure (IGST/CGST + SGST). |

||

|

Total

Amount |

|

Formula Examples:

- Cost Per Hour = ₹80,000 / 160 = ₹500/hour

- Billing Amount = 140 hours × ₹500 = ₹70,000

- Tax (18%) = ₹70,000 × 0.18 = ₹12,600

- Total Bill = ₹70,000 + ₹12,600 = ₹82,600

4.2. Table 2: Monthly Work Schedule Overview

This table provides a quick view of:

- Number of working days in the month.

- Expected hours per day.

- Total standard hours for the month.

- Actual hours worked per resource.

This helps in validating proportional billing for partial months or deviations from full-time hours.

5. Taxation Guidelines (India-specific GST)

The applicable GST structure depends on the location of the company and the client:

5.1. CGST + SGST (Intra-State Transactions)

- When Applied: The Company and client are in the same state.

- Collected By: Central (CGST) and State Government (SGST).

- Rate Split: Typically, 9% CGST + 9% SGST = 18% total.

Example: Pune (Maharashtra) to Mumbai (Maharashtra): 9% CGST + 9% SGST

5.2. IGST (Inter-State Transactions)

- When Applied: The Company and client are in different states.

- Collected by: Central Government, redistributed to the destination state.

- Rate: Equal to the total GST (e.g., 18%).

Example: Pune (Maharashtra) to Bangalore (Karnataka): 18% IGST

Note:

Tax rates may vary based on service category and current government policies. Always verify with the latest GST schedule or consult a tax advisor.

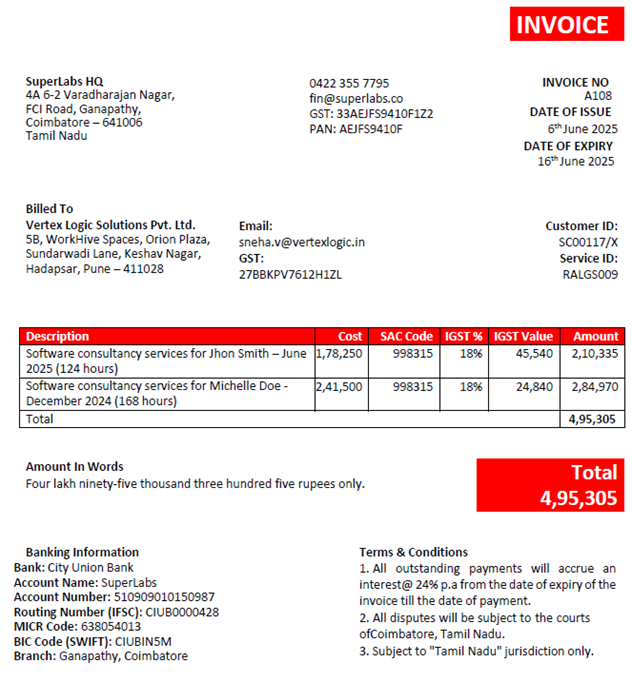

6. Fill Out the Invoice Template

|

Field |

Action |

|

INVOICE NO |

Increment

logically from the last invoice (e.g., i027) |

|

DATE OF

ISSUE |

Current invoice

creation date |

|

DATE OF

EXPIRY |

Add 10 days or

as per terms (e.g., 16th May 2025) |

|

Billed To |

Client name +

address from their records |

|

Customer ID

/ Service ID |

Reference IDs

from the contract |

|

Description |

Mention:

resource name, hours, and month clearly |

|

Cost |

From Step 2 |

|

SAC Code |

Use 998315 (IT Consulting) |

|

IGST % /

Value |

18% / computed

tax |

|

Amount |

Cost + Tax |

|

Total |

Sum of all line

items (₹4,95,305 in your example) |

|

Amount in

Words |

Convert to

words |

|

Bank Info |

Always verify

and update the latest bank details |

|

Terms |

Keep standard

legal terms about interest/jurisdiction |

Invoice Template:

6. Best Practices

- Maintain consistent time formatting

- Protect approved timesheets with read-only settings to prevent accidental changes.

- Maintain audit trails: Save approved versions of timesheets and billing sheets for reference.

- Reconcile invoices monthly with project deliverables and work logs to ensure alignment.