How to Prepare Payroll Report Using Ledger and Bank Statements

Guideline on how to prepare the Payroll report using the ledger and bank statements

1. Understand the Payroll Requirements

Before you begin preparing the payroll, it is important to understand the key components that form the foundation of the process. Start by collecting essential employee details such as their ID, name, designation, and the type of salary structure they follow—whether fixed, variable, or a combination of both. Next, identify the various types of payments that might be involved, including regular salaries, advances, performance-based incentives, and any refunds or adjustments. Reviewing the bank statement or ledger is also crucial, as it helps you extract and identify transactions related to salary payments. Additionally, refer to internal policies such as the company’s leave policy, applicable tax deductions, and the approved payroll structure to ensure compliance and consistency throughout the payroll process.

Before preparing payroll, gather and understand the following components:

- Employee details: ID, name, designation, salary structure (fixed/variable).

- Payment types: Salary, advance, incentives, refunds.

- Bank statement/ledger: Extract salary-related transactions.

- Policy references: Leave policy, tax deductions, and approved payroll structure.

2. Collect and Organize Source Data

a. Bank Ledger or Statement

Start by examining the bank ledger or statement to identify transactions related to payroll. Look for entries that are tagged under the payroll category, include notes referring to salary payments, incentives, or refunds, or involve parties that represent employees. These clues help isolate relevant transactions from general business activity.

Scan the ledger for transactions tagged under:

- Category: Payroll

- Notes indicating salary, incentives, or refunds.

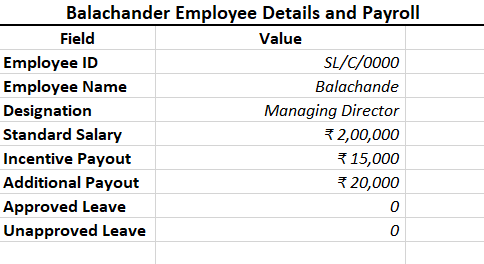

b. Employee Information Table

At the same time, compile a comprehensive employee information table. This should include each employee’s ID, name, designation, and standard monthly salary. It’s also important to note their payment type—whether it is fixed or variable—as well as maintain accurate records of their leave status, both approved and unapproved. This table serves as a reference point throughout the payroll preparation process.

Create or collect a master list of employee details, including:

- Employee ID

- Name

- Designation

- Standard Salary (monthly base)

- Leave records (Approved and Unapproved)

Example:

3. Classify Payroll Transactions

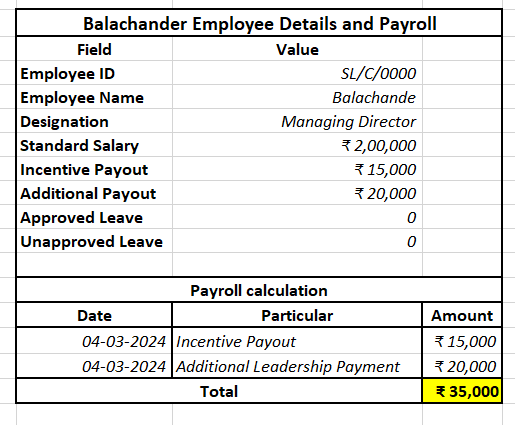

Once the relevant salary transactions have been identified in the ledger, the next step is to classify them based on their nature. Start by grouping regular monthly payments under fixed salary, for example, a recurring payment of ₹48,173 to Tomojit. Any early payments made before the usual salary date should be categorized as advances, such as ₹50,764 paid to Adarsh. Incentive or performance-based payments, which can vary depending on individual or business performance, should be recorded separately—for instance, ₹15,000 and ₹20,000 given to Balachande. Finally, note any refunds, which may include salary amounts returned or adjusted, such as a ₹25,000 return from Rekha Singh. This classification helps maintain clarity and structure in payroll records.

From the ledger, extract relevant salary transactions. Group them under:

- Standard salary: Regular payments (e.g., ₹48,173 for Tomojit)

- Advances: Early payments (e.g., ₹50,764 for Adarsh)

- Incentives: Additional or reduced salary depending on business performance (e.g., ₹15,000 + ₹20,000 for Balachande)

4. Construct Individual Payroll Sheets

For clarity and detailed tracking, prepare a separate payroll sheet for each employee. Start with an employee profile section that includes their ID, name, designation, standard monthly salary, any applicable incentives or additional payments, and a summary of their leave records—both paid and unpaid. Following the profile, include a salary breakdown section. Here, calculate the gross salary by adding the standard salary to any incentives or additional pay. Then, list the deductions, which may include unpaid leave and applicable taxes. Subtract these deductions from the gross salary to arrive at the net pay, which is the final amount payable to the employee for that period.

Prepare one payroll sheet per employee, containing:

Employee Profile Section:

- Employee ID, Name, Designation

- Standard salary

- Incentives, additional pay

- Leave information

Example:

5. Validate with Ledger

Cross-verify:

- Amounts match exactly with ledger entries

- Dates correspond with payout timing

- No duplication or missing entries

Remember

Some transactions may indicate that funds have been transferred from the company’s account to the proprietor’s account. Be cautious—these could be loan repayments or other forms of reimbursements, not salary payments. Review each transaction carefully.