How to Convert Bank Statements into Master Ledger

A guideline on how to convert a bank statement into a ledger for better understanding and analysis

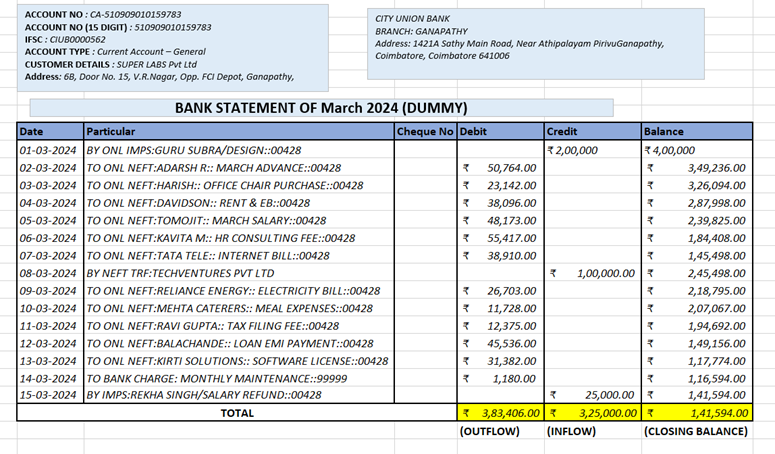

1. Understanding the Bank Statement

1.1 What is a Bank Statement?

A bank statement is a financial document issued by a bank that provides a detailed record of all transactions in a bank account over a specified period, usually a month. It is an essential tool for verifying financial activity, monitoring business cash flow, and preparing financial reports

1.2 Typical Elements of a Bank Statement:

- Account Holder Details: Name, account number, address, account type

- Statement Period: Start and end dates of the reporting month

- Opening & Closing Balance: Balance at the beginning and end of the period

- Transaction List:

- Date: The day the transaction was processed

- Description: Details about the transaction

- Debit: Amount deducted from the account

- Credit: Amount added to the account

- Running Balance: Balance after each transaction

- Bank Charges and Interest (if applicable)

1.3 Purpose:

Bank statements help account holders to:

- Monitor all cash inflows and outflows

- Track unauthorized activity or errors

- Reconcile their internal financial records

- Prepare for audits or tax filings

1.4 Bank Statement Example:

2. Why a Master Ledger is Needed

While bank statements provide raw data, they are difficult to interpret directly for financial reporting or internal reviews. They lack structured categorization and contextual information. Therefore, the data must be converted into a Master Ledger, which is a standardized, readable, and analyzable format.

This conversion helps in:

- Generating financial reports (profit/loss, cash flow, etc.)

- Classifying transactions for compliance and tax filing

- Enabling decision-making through clear summaries

- Tracking vendor and customer payments

- Monitoring salary, loan repayments, and capital expenditure

3. What is a Master Ledger?

The Master Ledger is the central reference table used by finance teams. It structures and enriches bank transactions with categorized and contextual details that facilitate reporting, analysis, and reconciliation.

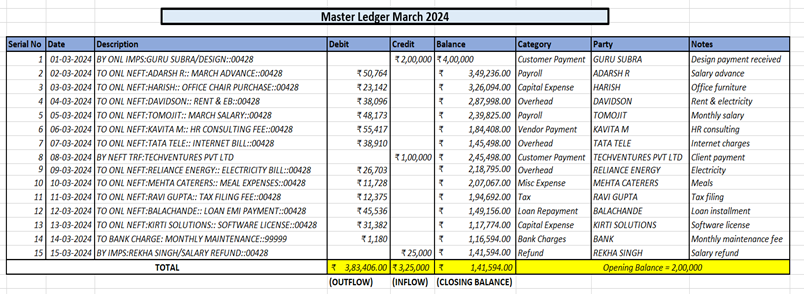

3.1 Master Ledger Example:

It includes the following enhancements:

- Structured rows for each transaction

- Categorized spending and income for analysis

- Identified stakeholders involved in transactions

- Clarifying notes to reduce ambiguity

3.2 Columns & Their Purpose

|

Column |

Description |

Purpose |

|

Serial No. |

Manually assigned ID |

Enables referencing and error

tracking |

|

Date |

The transaction date from the bank |

Shows the timing and order of

transactions |

|

Description |

As written in the bank statement |

Helps match transactions during

audits |

|

Debit (-) |

Amount paid/spent |

Indicates cash outflow |

|

Credit (+) |

Amount received |

Indicates cash inflow |

|

Balance |

Balance after transaction |

Ensures reconciliation and

integrity |

|

Category |

Predefined financial label |

Used for classification and

filtering |

|

Party |

Person or organization involved |

Provides clarity on stakeholder

engagement |

|

Notes |

Additional context |

Helps clarify unusual or recurring

entries |

4. Chart of Accounts - Categories Explained

This is a standard classification system that ensures each transaction is assigned a meaningful category.

|

Category |

Use Case |

Example |

|

Customer Payment |

Income from clients or customers |

Payment from TECHVENTURES PVT LTD |

|

Vendor Payment |

Payment for goods/services |

HR consulting, meals, and design

service |

|

Payroll |

Employee salaries and advances |

Salary to TOMOJIIT, advance to

ADARSH |

|

Tax |

Regulatory payments or consulting |

Tax filing by RAVI GUPTA |

|

Overhead |

Operational expenses |

Rent, electricity, and internet |

|

Misc Expense |

One-off costs |

Unusual meals or items |

|

Loan Repayment |

EMI or loan instalments |

Payment to BALACHANDE |

|

Capital Expense |

Fixed asset purchases |

Software license, office furniture |

|

Bank Charges |

Maintenance or service fees |

Bank fee on 14-03-2024 |

|

Investment Income |

Interest or dividends |

Applicable to savings/investments

only |

|

Refund |

Refunds from employees or vendors |

Refund from REKHA SINGH |

5. Step-by-Step Conversion Process

- Obtain the bank statement in PDF or Excel format

- Extract transaction data: Date, Description, Debit, Credit, Balance

- Create a Master Ledger spreadsheet using a template

- Assign a serial number to each transaction row

- Copy transaction details into the relevant columns

- Categorize each transaction using the Chart of Accounts

- Identify the party involved using support documents (see next section)

- Add explanatory notes where needed

- Ensure the running balance matches the closing balance in the statement

6. Supporting Information Required for Classification

To accurately identify and classify transactions, the following data must be available for the specific month/quarter/year:

- Employee List: Name, designation, payment structure

- Vendor List: Registered vendors, purpose of services/products

- Customer List: Client names and expected payment cycles

- Loan Schedule: EMI dates and amounts

- Recurring Overhead List: Rent, electricity, internet service providers

Why this is important: Without this data, interns or analysts might misclassify transactions, leading to errors in financial reporting and poor decision-making.

7. Applications of the Master Ledger

Once finalized, the Master Ledger can be used for:

- Profit & Loss Reporting: Distinguish between income and expense

- Cash Flow Analysis: Understand liquidity and fund movements

- Customer Reports: Show payment histories

- Vendor Management: Track expenses per supplier

- Payroll Summaries: Group employee salary-related transactions

- Loan Monitoring: Track EMIs and interest expenses

- Tax Preparation: Summarize all tax-related outflows

- Monthly Dashboard Creation: Input for KPIs and performance summaries