A Deep Dive into Loan Against Securities.

Loan Against Securities (LAS): Secure instant liquidity by pledging investments (stocks, MFs). Enjoy lower interest, avoid capital gains tax, and retain portfolio growth. A smart, flexible solution for immediate capital needs.

In today’s financial landscape, individuals usually find themselves navigating through sudden emergencies or opportunities. Whether it is a business venture, a medical need, or just a simple dream house that they have dreamt of for years. In such cases, access to liquidity without disturbing long-term investment becomes crucial and game game-changer.

This is where Loan Against Securities (LAS) steps into the picture. It is known by another name in the international market, that is, Securities Backed Line of Credit. Though it has been in the picture for a long time, it remains underutilized. As the name suggests, it is a financial instrument that lets you unlock the value of your existing portfolio without liquidating your assets. So let us explore this underappreciated instrument in detail.

1. What exactly is Loan Against Securities (LAS)?

A Loan Against Securities is a type of secured loan where borrowers pledge financial instruments such as shares, mutual funds, ETFs, Fixed Deposits, or bonds as collateral for a loan. Whereas in traditional loans that rely on income proof and credit scores, LAS leverages the inherent value of your financial assets at your disposal to assess eligibility for the loan dispersal.

Key Features:

Collateralized Borrowing: Your investments are pledged, not sold.

Loan-to-Value (LTV) Ratio: Typically, 50% to 70% of the current market value of the securities can be availed as a loan.

Disruption-free Liquidity: Your long-term investment goals remain intact, as the assets continue to earn return (e.g., dividend or NAV Growth).

2. The Operational Framework of LAS: How it works

The operational mechanics of LAS facility are streamlined for efficiency and borrower convenience.

Lenders: Predominantly, LAS facilities are offered by scheduled commercial banks and Non-Banking Financial Companies (NBFCs) regulated by Reserve Bank of India.

Accepted Instruments: As detailed above, a wide array of financial securities is accepted as collateral. The eligibility of specific securities may vary slightly across Lenders.

Loan Disbursal: Once your assets and pledging of assets, the loan amount disbursed. A unique feature of many LAS products is their structure as an overdraft facility. This means a credit limit is sanctioned against the pledge securities, but borrower is charged interest only on amount drawn down and utilized, not on the entire sectioned limit. This pay per use model significantly enhance cost efficiency.

Interest Accrual and Repayment: Interest typically accrues daily on the utilized amount.

repayment structures are often highly flexible, allowing borrowers to opt for:

· Interest Only Payments: Where only the interest component is paid periodically, with the principal repaid as a lump sum at the borrower’s convenience or at loan maturity

·Equated Monthly Instalments (EMIs): A structured repayment plan for both principal and interest.

Loan tenures typically range, with some platforms extending up to 36 months, providing ample time for financial manoeuvrability.

Example

Consider an individual pledging 5,00,000 INR worth of diversified equity mutual funds. Now, assuming an LTV of 60%, a loan limit of 3,00,000 INR is sanctioned. If the individual withdraws only 50,000 INR to cover unexpected expenses, interest will be levied solely on this 50,000 INR for the time frame that remains outstanding, not on the full 3,00,000 INR limit.

3. Spotlight: Loan Against Mutual Funds (LAMF)

A specialized and increasingly popular facet of LAS is Loan Against Mutual Funds, which leverages a mutual fund's portfolio as collateral for the loan. The advent of fintech platforms has revolutionized the LAMF to a great extent. offering unprecedented speed and digital convenience.

Key Features of Digital LAMF

- Expedited Process: Most of the applications can often be completed in just under 5 minutes, with funds potentially disbursed within 2 hours of approval, addressing urgent liquidity needs swiftly.

- Fully Digital Workflow: This eliminates cumbersome paperwork through online application, e-KYC, and digital agreement signing.

Application Steps

- Platform Access: Log in to the designated digital platform

- Navigation: Locate and select the 'Loan Against Mutual Funds' option.

- Identity Verification: Provide Permanent Account Number (PAN) and Date of Birth. Authenticate via a One-Time Password (OTP) sent to an Aadhaar-linked mobile number for e-KYC.

- Bank and Asset Selection: Link the desired bank account for fund disbursal and auto-debit. Crucially, select the specific mutual fund units from your Demat account that you intend to pledge. The platform typically displays eligible funds and the maximum loan amount available.

- Digital Agreement: Review and digitally sign the loan agreement, often facilitated via e-signatures or Aadhaar OTP.

This streamlined process underscores the technological advancements making LAS more accessible and user-centric than ever before.

4. Eligible Securities for Loan Against Securities (LAS)

Understanding the types of securities accepted as collateral is crucial for maximizing the utility of LAS:

- Equities (Listed Shares): High-value and generally liquid assets. However, their inherent market volatility means lenders may apply lower LTV ratios and mandate vigilant monitoring. Significant market downturns can trigger margin calls, requiring the borrower to provide additional collateral or repay part of the loan.

- Mutual Fund Units: Highly favoured collateral due to their inherent diversification and professional management, which generally translates to lower volatility compared to individual stocks. Both equity-oriented and debt-oriented mutual funds are commonly accepted, offering a broad spectrum for pledging.

- Fixed-Income Securities: Government bonds, corporate bonds, and debentures offer stability and predictable returns. Their lower risk profile makes them attractive collateral, often leading to higher LTV ratios from lenders due to their consistent valuation.

- Exchange Traded Funds (ETFs): Combining the diversification of mutual funds with the liquidity of stocks, ETFs are increasingly accepted as collateral. Their tradability on exchanges and diversified nature make them robust assets for pledging.

- Insurance Policies: Specifically, certain endowment and Unit-Linked Insurance Plan (ULIP) policies that have accrued a surrender value are accepted. The loan amount typically correlates with this accumulated surrender value.

5. The Strategic Advantage: Why Opt for Loan Against Securities Over Other Borrowing Avenues?

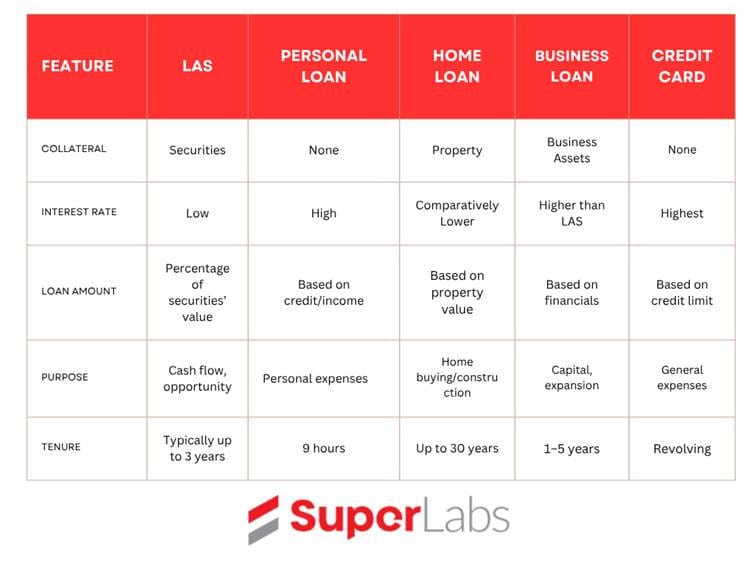

When faced with an immediate need for capital, whether it is for any unforeseen emergencies, strategic investments, or bridging cash flow gaps in business, individuals and businesses often evaluate various lending products. While personal loans, credit card facilities, and business loans serve distinct purposes, Loan Against Securities (LAS) frequently emerges as a better option and more financially astute choice. This preference is rooted in several fundamental advantages that differentiate LAS as a sophisticated financial instrument.

1. Portfolio Preservation and Continued Asset Appreciation

A cornerstone benefit of LAS is its ability to provide liquidity without necessitating the liquidation of your investment portfolio. Unlike selling equity shares or mutual fund units, which crystallize gains (or losses) and remove the asset from your portfolio, LAS allows you to merely pledge these securities as collateral. Your investments remain in your demat account, retaining their potential for future capital appreciation, dividend income, and other corporate actions. This preservation of long-term wealth creation, even while accessing short-term funds, is a critical differentiator from alternative financing methods.

2. Superior Interest Rate Dynamics

A primary driver for choosing LAS is its inherently lower cost of borrowing. As a secured loan, backed by liquid financial assets, the inherent risk to the lender is significantly mitigated. This reduced risk profile translates directly into more competitive interest rates compared to unsecured alternatives such as personal loans or credit card advances, which carry substantially higher rates to compensate for the absence of collateral. The resultant lower interest outgo can lead to significant cost savings over the loan's tenure, improving overall financial efficiency.

3. Enhanced Tax Efficiency

The act of selling appreciated investments triggers a taxable capital gains event. By opting for LAS, you are obtaining a loan, not executing a sale. This distinction is crucial for tax planning, as it avoids an immediate capital gains tax liability. For investors holding highly appreciated assets or those strategically managing their tax calendar, LAS offers a mechanism to access funds without prematurely incurring a tax burden, thereby optimizing their overall tax position.

4. Optimized Cost Management Through Overdraft Functionality

Many LAS facilities are structured as an overdraft line of credit. This highly flexible model allows borrowers to draw funds only as and when required, and interest accrues solely on the utilized amount, not on the entire sanctioned limit. This contrasts sharply with traditional term loans where interest commences on the full disbursed principal from day one. The "interest on usage only" feature significantly enhances cost efficiency, empowering borrowers to manage their effective interest burden more precisely.

5. Unparalleled Repayment Flexibility and Absence of Prepayment Penalties

LAS typically offers more accommodating repayment structures. Borrowers often have the option for interest-only payments for a specified period, with principal repayment at their convenience or upon maturity. Furthermore, a significant advantage is the general absence of prepayment or foreclosure charges. This flexibility empowers borrowers to repay the loan partially or in full ahead of schedule without incurring additional penalties, a common charge with many other loan products, thus providing greater liquidity management control.

In essence, LAS represents a sophisticated and strategically sound financing solution that allows individuals and entities to leverage their existing investment wealth effectively. It offers a unique blend of cost efficiency, flexibility, and portfolio preservation that is rarely matched by conventional loan products, making it a preferred choice for informed borrowers.

6. Key Benefits of Embracing Loan Against Securities

Beyond the comparative advantages, LAS offers a suite of intrinsic benefits that underscore its value proposition:

- Attractive Interest Rates: As highlighted, the secured nature of LAS enables lenders to offer highly competitive interest rates, often significantly lower than unsecured borrowing options (e.g., approximately 10.5% per annum on some digital platforms).

- Simplified Eligibility Criteria: For individual investors, the primary eligibility requirements typically revolve around Indian citizenship and having mutual fund units or shares in Demat form. This often bypasses the rigorous income and credit score assessments characteristic of unsecured loans.

- 24x7 Accessibility and Digital Management: Many contemporary LAS providers offer a fully digital ecosystem, enabling borrowers to apply, monitor their loans, and manage their pledged assets round the clock via online portals or mobile applications, enhancing convenience and control.

- Interest on Utilized Amount Only: The overdraft-like functionality ensures that interest costs are precisely aligned with actual fund usage, preventing unnecessary accruals on unutilized sanctioned limits.

- Flexible Repayment Options & Zero Foreclosure Charges: The ability to make partial or full prepayments without incurring additional penalties offers immense financial flexibility, empowering borrowers to reduce their interest burden or close the loan early as their cash flow permits.

7. Eligibility Criteria for LAS

While criteria can vary slightly by lender, common eligibility parameters for digital LAS platforms typically include:

- Age: Borrower must be within a defined age bracket, commonly 18 to 70 years.

- Investor Type: Primarily individual investors. Non-Resident Indians (NRIs) and Hindu Undivided Families (HUFs) are often excluded from certain digital-first offerings due to regulatory complexities.

- Securities Holding: Crucially, the mutual fund units or shares intended for pledging must be held in Demat form. Physical certificates or Statement of Account (SOA) holdings generally require dematerialization before pledging.

- KYC Compliance: A fully compliant Know Your Customer (KYC) profile is mandatory, typically requiring a PAN card linked to an Aadhaar card with a registered mobile number for e-verification and digital signing.

8. Essential Documentation for LAS Application

- The digital nature of modern LAS facilities significantly streamlines the documentation process. Generally, the following documents are required:

- PAN Card: Serves as the primary identity proof.

- Aadhaar Card: Utilized for address verification and for Aadhaar-based OTP authentication during digital signing processes.

- Bank Details: Required for the seamless disbursement of loan funds and for setting up auto-debit mandates for interest/EMI repayments.

- Demat Account Details: Information about the dematerialized account where the securities to be pledged are held. This facilitates the electronic marking of the lien by the lender.

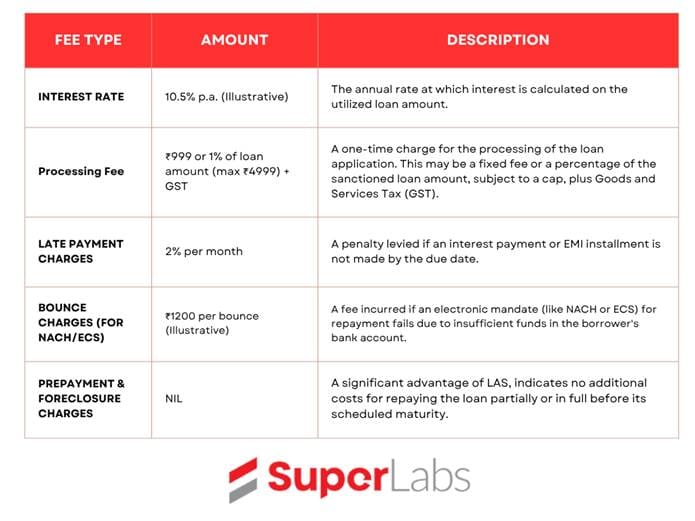

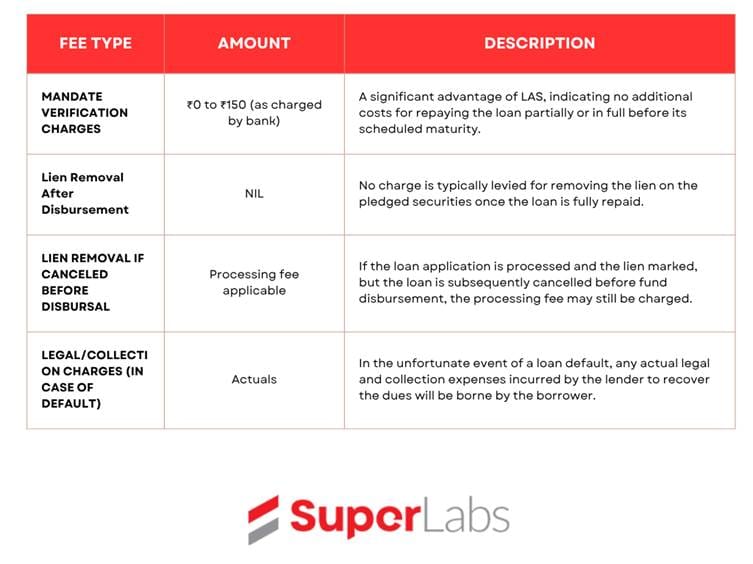

9. Understanding Fees and Charges Associated with LAS

- While LAS is cost-effective, transparency regarding all associated fees is critical. A typical breakdown, using an example from a digital platform, might include:

It is imperative for borrowers to meticulously review the specific fee structure provided by their chosen lender to ensure complete transparency and avoid unexpected costs.

10. Specific Consideration: Loan Against Shares (LAS - Equity Focus)

While the broader LAS encompasses various securities, a specific focus on Loan Against Shares (LAS), where individual equity shares are pledged, warrants additional consideration.

Loan Amount: Similar to other LAS products, the loan amount is based on the market value of the pledged shares, subject to the lender's LTV policy.

Advantages:

- High Liquidity: Shares of actively traded companies are highly liquid, making them attractive collateral.

- Ownership Retention: Allows investors to retain ownership of their company shares, benefiting from long-term growth.

Key Risk: Market Volatility and Margin Calls: The primary risk associated with LAS against shares is their inherent price volatility. If the market value of the pledged shares drops significantly, the lender may issue a margin call. This obliges the borrower to:

- Provide additional collateral (more shares or other eligible securities).

- Repay a portion of the outstanding loan.

- In the absence of the above, the lender reserves the right to liquidate (sell) a portion of the pledged shares to restore the LTV ratio, potentially at unfavorable market prices. Responsible management of LAS against equities necessitates continuous monitoring of market performance and maintaining a sufficient buffer.

11. Managing LAS Responsibly: A Prudent Approach

While LAS offers remarkable flexibility, responsible management is paramount to harnessing its benefits effectively:

- Monitor Market Volatility: Particularly when pledging volatile assets like individual stocks, it is crucial to remain vigilant about market movements. Avoid pledging an excessive portion of your portfolio or highly volatile stocks during periods of anticipated market downturns to mitigate the risk of margin calls.

- Select a Reputable Lender: Prioritize established banks or well-regulated NBFCs with transparent policies, competitive rates, and a strong track record of ethical lending. Thoroughly review the loan agreement, terms, and conditions before commitment.

- Understand Repayment Obligations: Be fully cognizant of the interest rates, repayment schedule (whether interest-only or EMI), and tenure. Ensure your cash flow projections can comfortably accommodate the repayment obligations.

12. Pre-Application Checklist: Ensuring a Smooth Process

Before initiating an LAS application, a systematic checklist can ensure a seamless experience:

- Verify Eligibility and Documentation: Confirm that you meet the lender's specific eligibility criteria and have all required documents (PAN, Aadhaar, bank details, Demat account info) readily accessible and in order.

- Comprehend Repayment Terms: Clearly understand the interest rate, fee structure, repayment modalities, and the implications of the overdraft facility.

- Regular Asset Monitoring: Commit to regularly monitoring the market value of your pledged assets, especially if they are subject to market fluctuations, to proactively manage any potential margin call scenarios.