Opportunities & Operational Imperatives on Synthetic Diamonds

Global synthetic diamond market valuations, technological evolution & growth.

The synthetic diamond market is experiencing a period of dynamic growth and technological evolution, presenting both significant opportunities and complex challenges for prospective manufacturers. Global market valuations are expanding, with particularly accelerated growth observed in the lab-grown diamond (LGD) segment for jewelry, driven by consumer demand for more affordable and ethically sourced alternatives to natural diamonds. Industrial applications, however, continue to form the bedrock of the synthetic diamond sector, with established demand in abrasives, cutting tools, and increasingly, in high-technology fields like electronics and semiconductors.

Venturing into synthetic diamond manufacturing requires careful consideration of numerous strategic factors. The primary advantages include lower production costs relative to mined diamonds, the appeal of ethical and sustainable narratives, and access to a rapidly growing market. Conversely, disadvantages encompass high initial capital expenditure for specialized machinery, the need for advanced technical expertise, significant energy consumption during production, and ongoing market challenges such as price volatility and evolving consumer perceptions regarding the value and "realness" of LGDs.

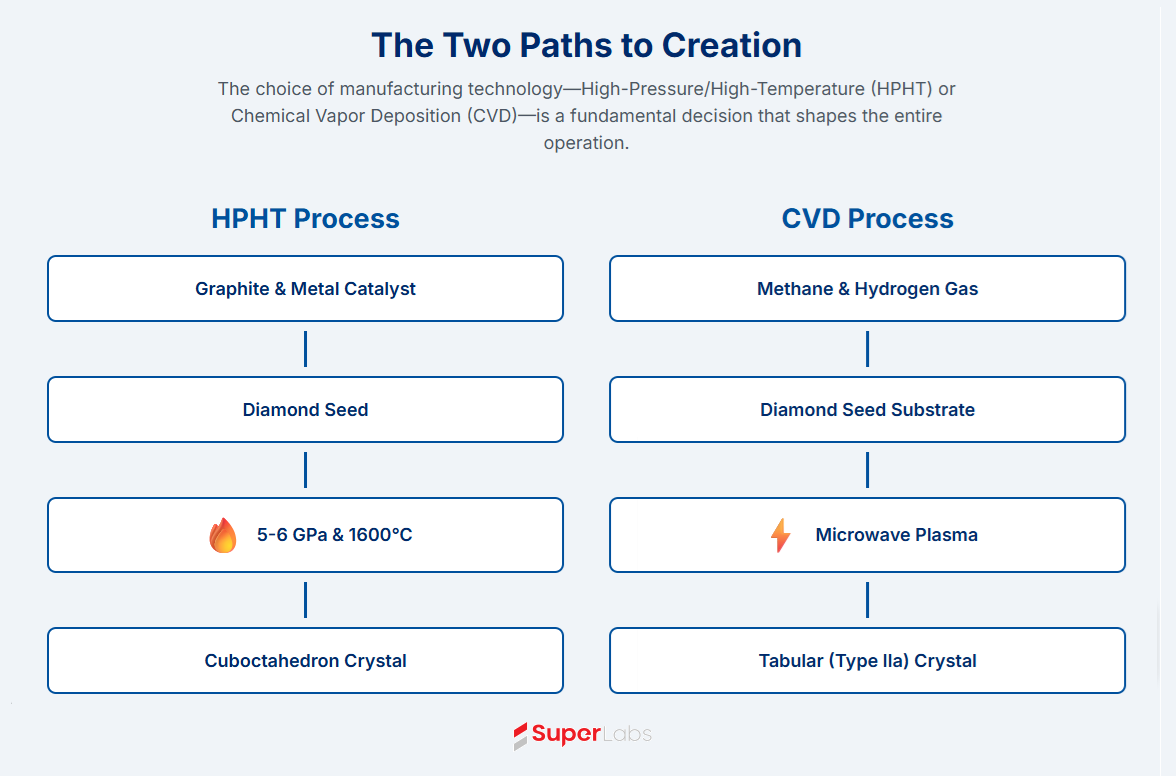

Two principal manufacturing technologies dominate the landscape: High-Pressure/High-Temperature (HPHT) synthesis and Chemical Vapor Deposition (CVD). Each method possesses distinct characteristics concerning raw material inputs, operational parameters, output quality, energy consumption, and cost structures, influencing their suitability for different market segments. The choice of technology is a foundational strategic decision with long-term implications.

Establishing a manufacturing facility necessitates substantial investment in core production machinery (HPHT presses or CVD reactors), ancillary equipment for cutting, polishing, and quality control, and robust infrastructure. The required personnel include highly skilled scientists, engineers, technicians, and operators with specialized knowledge in materials science, physics, chemistry, and precision manufacturing.

The regulatory environment is also a critical consideration. International bodies like the U.S. Federal Trade Commission (FTC) and national authorities, such as those in India (Bureau of Indian Standards, Central Consumer Protection Authority), have implemented stringent guidelines for the labeling and disclosure of synthetic diamonds to ensure consumer transparency and market integrity. Concurrently, some governments, notably India's, are actively promoting domestic LGD manufacturing through policy support.

This report provides a comprehensive analysis of these facets, aiming to equip potential investors and strategic planners with the necessary information to evaluate the feasibility of entering the synthetic diamond manufacturing industry. It delves into market dynamics, the pros and cons of the venture, technological considerations, machinery and personnel requirements, raw material supply chains, the regulatory framework, and initial investment outlooks, concluding with key success factors and strategic recommendations. The industry's trajectory suggests that while opportunities for growth are abundant, success will hinge on technological prowess, operational efficiency, astute market positioning, and adaptability to a rapidly changing landscape.

II. The Global Synthetic Diamond Market Landscape

The global market for synthetic diamonds is characterized by robust growth, driven by expanding applications across jewelry, industrial sectors, and advanced electronics. Understanding its size, segmentation, and regional dynamics is crucial for any entity considering entry into this evolving industry.

A. Market Size, Growth, and Projections

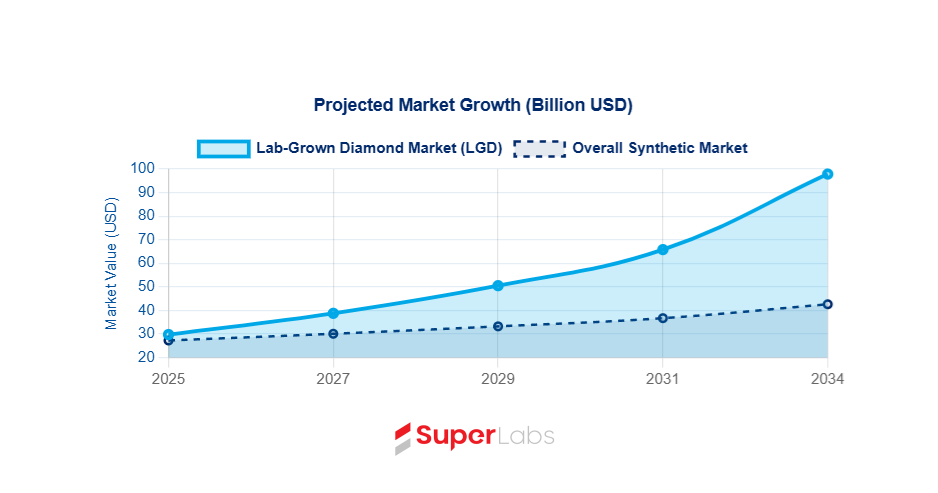

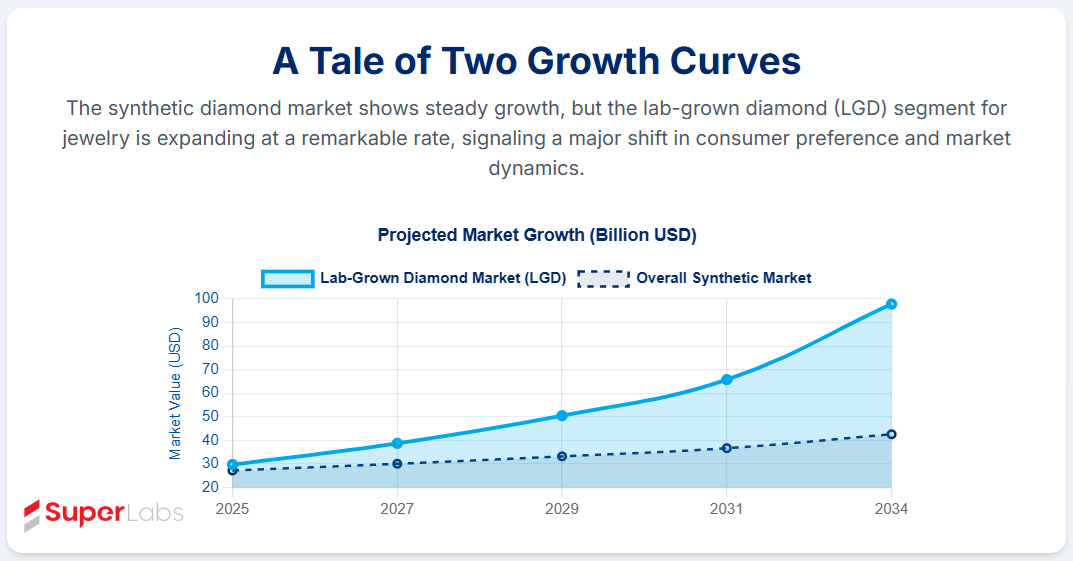

The synthetic diamond market has demonstrated significant expansion in recent years. In 2024, the global synthetic diamond market was valued at USD 25.9 billion, with projections indicating a compound annual growth rate (CAGR) of 5.1% between 2025 and 2034.1 An alternative assessment estimated the market at USD 27.73 billion for 2025, anticipating growth to USD 44.53 billion by 2032, which corresponds to a CAGR of 7.0%.2

Within this broader market, lab-grown diamonds (LGDs), particularly those destined for the jewelry segment, are experiencing even more accelerated growth. The LGD market was valued at USD 26.05 billion in 2024 and is forecast to expand to approximately USD 97.85 billion by 2034, reflecting a substantial CAGR of 14.15% from 2025 to 2034.3 This divergence in growth rates—a solid 5-7% for the overall synthetic market versus a much higher 14.15% for LGDs—highlights that while industrial applications provide a large and stable demand base, the gem-quality segment is currently the primary engine of aggressive market expansion. This distinction is fundamental for new entrants in defining their market focus and strategic approach, as targeting industrial versus jewelry applications involves different market dynamics, customer requirements, and competitive pressures. For context, the total diamond industry, encompassing both natural and synthetic stones, was valued at USD 94.3 billion in 2021, with a projected value of USD 139.9 billion by 2032.1

B. Key Market Segments

The synthetic diamond market serves diverse applications, each with unique characteristics and growth drivers.

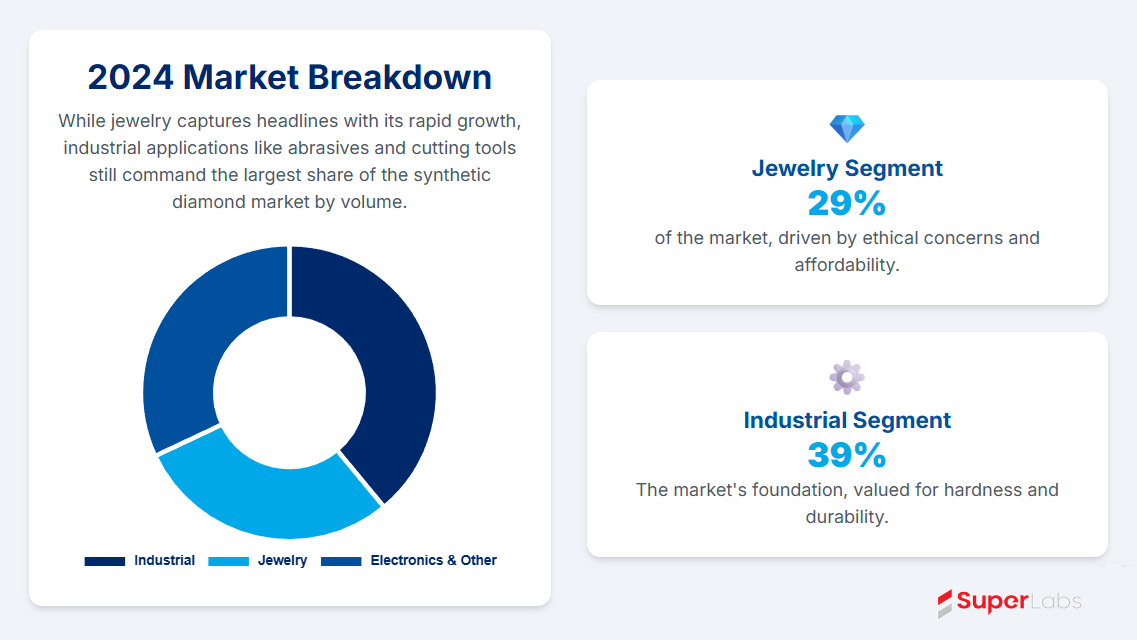

- Jewelry: This segment is exhibiting the most rapid growth, registering a 5.6% CAGR and constituting 29% of the total synthetic diamond market in 2024.1 The increasing consumer preference for LGDs in jewelry is largely attributed to their lower price point compared to natural diamonds and their appeal as an environmentally friendly and ethically sourced option.1 The overall global diamond jewelry market, which includes natural diamonds, was estimated at US358.1billionin2024andisprojectedtoreachUS437.2 billion by 2030 (a 3.4% CAGR), with a discernible shift towards LGDs strengthening the case for ethical and sustainable luxury.4 The dynamism of the jewelry segment presents a primary attraction for new LGD manufacturers, and the ongoing shift from natural diamonds underscores the disruptive potential of this technology.

- Industrial Applications: Despite the rapid growth in jewelry, industrial sectors such as cutting tools and abrasives continue to dominate the market in terms of volume, accounting for 39% of the market share in 2024.1 It is estimated that synthetic diamonds fulfill approximately 98% of the industrial-grade diamond demand.5 The Abrasive Tools Market alone was valued at USD 50.88 Billion in 2024.1 While the "ethical shine" of LGDs is a significant driver in the jewelry market, the industrial segment's reliance on synthetic diamonds is primarily due to their superior hardness, thermal conductivity, and consistent quality, making them indispensable for modern manufacturing and technology.5 This large and stable industrial base offers a different type of market opportunity, potentially characterized by higher volumes and different quality and cost considerations than the jewelry sector.

- Electronics and High-Tech: There is a burgeoning demand for synthetic diamonds in the electronics and semiconductor industries. Their exceptional thermal conductivity makes them ideal for use as heat spreaders for high-power laser diodes, transistors, and other electronic devices, preventing overheating and prolonging device lifespan.1 Diamond-based semiconductors are also gaining traction as a superior alternative to silicon in certain applications.1 This segment, encompassing electronics, medical devices (for precision instruments like surgical scalpels 6), and aerospace, is projected for high growth, with an average annual growth of 15% anticipated in the U.S. for these combined industries.1 This represents a future-oriented, high-value application segment where the unique physical properties of synthetic diamonds are paramount.

C. Major Producing Regions and Consumption Trends

Production and consumption of synthetic diamonds are geographically concentrated, yet show evolving patterns.

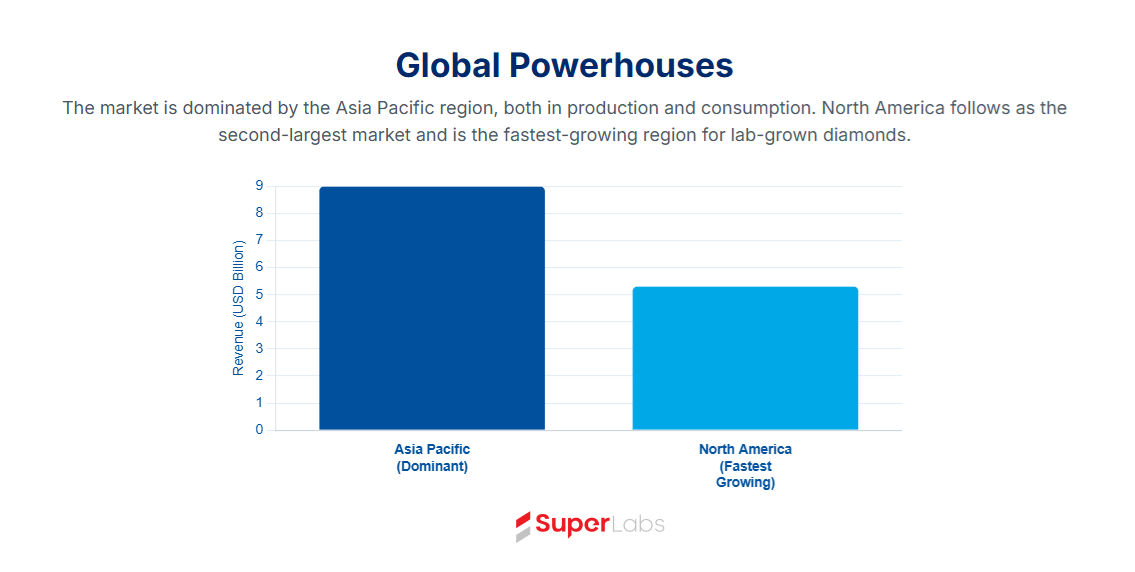

- Asia Pacific (APAC): This region is the dominant force in the synthetic diamond market, with revenues of USD 9 billion in 2024, projected to reach USD 14.9 billion by 2034.1 APAC's leadership stems from its robust manufacturing base and substantial industrial demand.1 In 2024, the region held a 34% share of the lab-grown diamond market.3

- China is a pivotal player within APAC and globally. The country produced 15.4 billion carats of synthetic diamond in 2019, with output expected to climb to 17.0 billion carats by 2026.7 China is also the leading producer of synthetic industrial diamonds.8 The synthetic diamond market in China is highly concentrated, with the top three producers accounting for approximately 76% of the market in 2019.7 This dominance, particularly in HPHT technology and industrial-grade diamonds, presents a significant competitive factor for new entrants. However, it may also create opportunities for diversification of supply chains, especially for Western markets or specialized, high-value applications.

- India has emerged as a major diamond processing center, handling around 90% of the world's rough diamonds by volume.9 The country is also rapidly growing its LGD sector, with its LGD jewelry market valued at $264.5 million in 2022 9 and accounting for 15% of global LGD production.10 Key LGD hubs include Surat and Mumbai.10 Government initiatives, such as the removal of import duties on LGD seeds 11, are further bolstering this growth, positioning India as an attractive alternative manufacturing location.

- North America (USA): The United States represents the second-largest market for synthetic diamonds globally, with revenues of USD 5.3 billion in 2024, projected to increase to USD 9.1 billion by 2034.1 The U.S. is a major consumer, particularly for LGD jewelry 1, and is also a significant producer of synthetic industrial diamonds.8 Furthermore, North America is identified as the fastest-growing region for lab-grown diamonds.3 The strong demand in the U.S., coupled with a burgeoning high-tech application sector, makes it a key market.

The following table summarizes the global synthetic diamond market landscape:

Table 1: Global Synthetic Diamond Market Overview

This overview underscores a market with substantial current value and strong future growth prospects, particularly within the lab-grown diamond segment for jewelry. However, the established industrial applications and the geographical concentration of production present a complex competitive environment that new entrants must navigate strategically.

III. Strategic Feasibility: Pros and Cons of Synthetic Diamond Manufacturing

Embarking on synthetic diamond manufacturing is a significant undertaking that presents a compelling array of advantages alongside notable challenges. A thorough assessment of these factors is essential for informed strategic decision-making.

A. Advantages

The production of synthetic diamonds offers several key benefits that contribute to its growing appeal for both businesses and consumers.

- Cost-Effectiveness & Affordability: A primary driver for the synthetic diamond market is the significant cost advantage LGDs offer over their natural counterparts. Lab-grown diamonds typically retail for 20-40% less than comparable natural diamonds 12, with some reports indicating price drops of as much as 83% between 2015 and 2024.9 This affordability allows consumers to acquire larger or higher-quality stones within their budget.3 For manufacturers and retailers, this can translate into potentially higher profit margins despite lower per-unit retail prices, as production costs are lower than mining.13

- Ethical Production & Sustainability: Synthetic diamonds circumvent many of the ethical concerns historically associated with natural diamond mining, such as conflict diamonds and exploitative labor practices.1 The manufacturing process occurs in a controlled laboratory environment, ensuring fair labor practices and transparent sourcing.12 Furthermore, LGDs are widely marketed as a more environmentally sustainable alternative. Their production does not involve large-scale mining operations, thereby reducing land disruption, deforestation, and associated habitat loss.3 The carbon footprint can also be smaller, particularly if renewable energy sources are utilized in the production process.1 This ethical and sustainable profile resonates strongly with a growing segment of consumers, especially Millennials and Gen Z.3

- Growing Market Demand & Acceptance: The demand for synthetic diamonds is robust and expanding across both jewelry and industrial applications.1 Consumer awareness and acceptance of LGDs are steadily increasing 9, creating a favorable market environment with space for new entrants.

- Technological Advancements & Customization: The field of synthetic diamond production is characterized by continuous technological innovation. These advancements are leading to improvements in the quality and efficiency of production, as well as reductions in cost.12 Manufacturers have the ability to create diamonds with specific characteristics, including various colors and sizes, tailored to meet diverse consumer and industrial demands.1

- Controlled Quality & Supply: Manufacturing diamonds in a laboratory setting allows for a high degree of control over the production process. This results in a more consistent quality of diamonds and a predictable, reliable supply chain, which contrasts with the geological uncertainties and logistical complexities inherent in natural diamond mining.6 This consistency is particularly advantageous for industrial applications requiring specific material properties and for large-scale jewelry production.

- Diversification for Existing Businesses: For companies already involved in the natural diamond industry, venturing into LGD manufacturing or retail offers an opportunity to diversify their product portfolio and cater to a broader segment of the market.9

B. Disadvantages and Challenges

Despite the compelling advantages, establishing and operating a synthetic diamond manufacturing facility involves significant hurdles and potential drawbacks.

- High Initial Capital Investment: The setup of a synthetic diamond production facility requires substantial upfront capital. This includes investment in specialized and expensive machinery such as HPHT presses or CVD reactors, the construction or modification of suitable infrastructure (including clean rooms for CVD), and the provision of robust utilities.1 Estimates suggest that equipment costs alone can range from $250,000 to over $2 million, depending on the chosen technology and scale of operation.13

- Complex Manufacturing Process & Technical Expertise: The production of synthetic diamonds is a technologically intensive endeavor. It demands a deep understanding of materials science, physics, and chemistry, as well as specialized knowledge for operating and maintaining the sophisticated equipment involved.2 Acquiring and retaining the necessary skilled personnel can be a significant challenge.

- Energy Consumption: Synthetic diamond manufacturing processes, particularly HPHT, are known for their high energy consumption.1 This not only contributes to operational costs but can also impact the credibility of "eco-friendly" claims, especially if the energy is sourced from fossil fuels.23 While LGDs are often marketed as sustainable, this high energy demand presents a potential paradox. True sustainability is heavily contingent on the source of this energy; reliance on non-renewable sources could undermine the environmental benefit narrative. This situation creates both a vulnerability for the industry's green image and an opportunity for manufacturers who can verifiably demonstrate the use of renewable energy sources. The "how" a lab-grown diamond is made is becoming as important as "that" it is lab-grown.

- Market Perception, Resale Value, and "Realness": A persistent challenge for LGDs, particularly in the jewelry market, is consumer perception. Some consumers view LGDs as having lower intrinsic value or limited to no resale value when compared to natural diamonds.3 The emotional and sentimental value attached to natural diamonds, often associated with their geological origin and rarity, may be perceived as lacking in LGDs.9 This is a key marketing hurdle that the industry continues to address.

- Price Volatility and Declining Prices: The increasing supply of LGDs, driven by technological advancements and new market entrants, has led to a noticeable decline in their prices.9 While lower prices benefit consumers, they can squeeze profit margins for manufacturers and retailers.24 This price volatility also affects the perception of LGDs as a store of value. The falling prices increase affordability and market penetration, which is an advantage. However, this same trend can undermine their status as traditional luxury goods and erode their perceived long-term value, potentially bifurcating the market into LGDs for accessible fashion and natural diamonds for enduring luxury. Manufacturers must navigate this deflationary price environment carefully.

- Competition: The synthetic diamond market is becoming increasingly competitive. Established players, particularly large-scale manufacturers in China, have significant market share, and new entrants are continually emerging.1 New businesses must develop a clear and compelling value proposition to compete effectively in this crowded field.

- Quality Concerns (Perceived or Real): Although technology has significantly improved the quality of LGDs in terms of color, clarity, and durability 1, historical concerns or negative perceptions can linger among some consumers.3 Ensuring consistent high-quality production and transparent, credible grading is essential to overcome these perceptions.

- Regulatory Scrutiny & Labeling Requirements: To protect consumers and maintain market integrity, regulatory bodies worldwide have implemented strict rules regarding the disclosure and labeling of LGDs to clearly differentiate them from natural diamonds.24 Compliance with these regulations is mandatory and adds an operational and legal burden.

- Impact on Traditional Diamond Mining Communities: While LGDs address ethical concerns related to conflict diamonds, a potential counter-argument is the socio-economic impact that a large-scale shift to LGDs could have on communities traditionally reliant on natural diamond mining.16

The rapid pace of technological progress in LGD production acts as a double-edged sword. While it continuously lowers production costs and improves diamond quality—clear advantages for new, agile entrants deploying the latest technology—it also accelerates the potential for market saturation and further price declines. This can pose a threat to established players with older, less efficient equipment and higher cost structures. The dynamism of innovation means that today's cutting-edge process might become the baseline standard tomorrow, necessitating continuous research and development investment to maintain a competitive edge. This underscores the criticality of the initial technology choice and the inherent capacity for future upgrades and adaptation.

Table 2: Summary of Pros and Cons for Entering Synthetic Diamond Manufacturing

A careful evaluation of these factors, weighed against specific business goals and resources, is paramount before committing to a synthetic diamond manufacturing venture.

IV. Synthetic Diamond Manufacturing Technologies

The creation of synthetic diamonds primarily relies on two advanced technological processes: High-Pressure/High-Temperature (HPHT) synthesis and Chemical Vapor Deposition (CVD). Each method replicates different natural diamond-forming environments and possesses unique operational characteristics, raw material requirements, and output qualities. The choice between HPHT and CVD is a critical strategic decision for any prospective manufacturer.

A. High-Pressure/High-Temperature (HPHT) Synthesis

- Process Overview: The HPHT method essentially mimics the conditions deep within the Earth's mantle where natural diamonds are formed. The process involves placing a small diamond seed crystal into a growth cell containing a carbon source, typically high-purity graphite. This cell is then subjected to extreme pressures, generally in the range of 5 to 6 Gigapascals (GPa)—equivalent to over 50,000 times atmospheric pressure—and very high temperatures, typically between 1300°C and 1600°C, though some processes can reach up to 2000°C.22 A molten metal catalyst, commonly iron (Fe), nickel (Ni), cobalt (Co), or their alloys, is used to dissolve the carbon source. The dissolved carbon then precipitates and crystallizes onto the diamond seed, gradually growing a larger diamond crystal.30 The entire growth cycle can take from several days to a few weeks, depending on the desired size and quality of the diamond.31

- Raw Materials: The key inputs for HPHT synthesis are a high-purity carbon source (usually graphite powder), small diamond seed crystals (which can be natural or synthetic), and a metallic solvent/catalyst system.22 The quality and characteristics of these raw materials, especially the seed crystals, significantly influence the final product.

- Operating Conditions: As the name suggests, the defining parameters are high pressure (approximately 5-6 GPa) and high temperature (1300-1600°C, with some variations).22

- Output Characteristics: HPHT synthesis can produce diamonds in a range of colors, including colorless, yellow, brown, blue, green, and orange.5 The crystals typically grow in a cuboctahedron shape, with growth occurring in 14 different directions.31 A common characteristic of HPHT-grown diamonds can be the presence of minor metallic inclusions, which are remnants of the catalyst used in the growth process.29 The HPHT process is also frequently used as a post-growth treatment to enhance or change the color of diamonds, both natural and lab-grown.31

- Energy Consumption: HPHT synthesis is generally considered to be an energy-intensive process.22 Estimates vary depending on the specific press technology and scale. For instance, a single-stone HPHT press might consume 175–225 kilowatt-hours (kWh) per rough carat, which could translate to 650–1100 kWh per polished carat. More modern, larger multi-stone cubic HPHT presses are reported to be more efficient, using 75–150 kWh per rough carat, or approximately 350–700 kWh per successful polished carat.23 A significant portion of global HPHT diamond production occurs in China, where coal is a major source of electricity, impacting the overall carbon footprint of these diamonds.23

B. Chemical Vapor Deposition (CVD) Synthesis

- Process Overview: The CVD method creates diamonds under conditions analogous to those found in interstellar gas clouds. The process begins by placing a thin slice of a high-quality diamond, known as a seed substrate, into a vacuum chamber. The chamber is then filled with a carefully controlled mixture of gases, primarily a carbon-containing gas (typically methane, CH₄) and hydrogen (H₂). Energy, usually in the form of microwaves which generate a plasma, is introduced into the chamber. This energy breaks down the gas molecules into their constituent atoms, including reactive carbon and hydrogen species. These carbon atoms then deposit onto the surface of the diamond seed, layer by atomic layer, leading to the growth of a larger, high-quality diamond crystal.22 The hydrogen plays a crucial role in etching away any non-diamond carbon (like graphite) that might form, ensuring the purity of the diamond growth. The growth process typically takes several weeks to produce a diamond of significant size.37

- Raw Materials: The primary raw materials for CVD diamond synthesis are thin, flat diamond seed substrates, a carbon source gas (methane being the most common), and hydrogen gas.22 The purity of these gases is critical to the quality of the resulting diamond.

- Operating Conditions: Compared to HPHT, CVD operates at significantly lower pressures (typically sub-atmospheric or low vacuum) and lower temperatures, generally in the range of 700°C to 1300°C, with many processes running around 800°C to 1000°C.22

- Output Characteristics: CVD is known for its ability to produce high-purity diamonds, often classified as Type IIa, which are chemically very pure and have excellent optical and thermal properties.22 CVD diamonds typically grow in a cubic or tabular shape, with growth predominantly occurring in one direction.31 Diamonds grown by CVD may initially exhibit a brownish or grayish tint and often require post-growth treatments, such as HPHT annealing, to improve their color (making them more colorless) or enhance their clarity.23 This post-growth treatment is an important consideration, as it represents an additional process step with its own associated costs, energy consumption, and expertise requirements, potentially affecting the overall economics and environmental footprint of CVD diamond production.

- Energy Consumption: The CVD process is generally considered to be more energy-efficient than HPHT due to its lower temperature and pressure requirements.22 One CVD producer estimated energy consumption at around 60–120 kWh per rough carat. However, due to the typical cube shape of CVD rough and potentially lower yields in polishing, the energy per polished carat was estimated to be higher, in the range of 1,000–1,700 kWh.23 As with HPHT, the actual environmental impact is also dependent on the source of the electricity used.

C. Comparative Analysis of HPHT and CVD

Both HPHT and CVD technologies are capable of producing high-quality diamonds, but they differ in several key aspects:

- Technology Maturity: HPHT is the older of the two methods, with gem-quality diamonds first produced in the 1950s. CVD technology for diamond growth was developed more recently, in the 1980s.31

- Cost: The capital cost for HPHT equipment, which involves heavy-duty presses capable of generating extreme pressures, can be substantial.31 CVD equipment, while also sophisticated, generally operates under less extreme conditions, potentially making it more cost-effective for certain types of gem-quality diamond production, although HPHT remains very cost-effective for producing industrial diamond grit and powders.18

- Diamond Quality & Characteristics: CVD processes offer a high degree of control over the growth environment, often resulting in diamonds with high clarity, fewer inclusions, and the ability to grow larger single crystals.22 These are often Type IIa diamonds. HPHT can produce a wide spectrum of diamond colors directly and is also known for producing diamonds with high clarity and color.31 However, HPHT diamonds may contain metallic inclusions from the catalyst, while CVD diamonds often require post-growth treatments to optimize their color.29

- Production Speed: Production times vary. HPHT can sometimes be faster for producing certain types or smaller sizes of diamonds 22, with some growth cycles lasting 6-8 weeks.31 CVD growth is an incremental, layer-by-layer process that can also take several weeks for substantial crystal growth.37

- Environmental Impact: CVD is generally perceived as having a lower direct environmental impact due to its lower energy requirements compared to HPHT.22 However, the overall environmental footprint for both methods is significantly influenced by the source of electrical power and the management of any chemical byproducts.

- Market Preference: CVD has been steadily gaining market share, particularly for gem-quality colorless and near-colorless diamonds, and was noted as the segment with the largest share by manufacturing method in 2024.3 HPHT remains a dominant technology for the production of industrial diamonds and is also used for specific types of gem-quality diamonds, including certain fancy colors.18

The choice of technology often dictates the initial market niche a new company might target. HPHT setups might be more readily geared towards industrial applications or smaller colored gemstones, while CVD facilities often aim for larger, high-clarity colorless gems for the jewelry market or specialized optical and electronic components. Both HPHT and CVD processes typically rely on diamond seeds to initiate and guide crystal growth.29 The quality, availability, and cost of these seeds are critical factors for successful and efficient diamond production. Difficulties in sourcing high-quality seeds of appropriate size and crystallographic orientation can impede production, reduce yield, and compromise the quality of the final diamonds. This creates a dependency on specialized seed suppliers or necessitates investment in in-house seed production capabilities, adding another layer of complexity and cost to the manufacturing venture. The Indian government's decision to remove import duties on LGD seeds underscores the strategic importance of this particular input material.11

Table 3: Comparative Analysis of HPHT and CVD Manufacturing Methods

This comparative analysis highlights that the selection between HPHT and CVD is a multifaceted decision, contingent upon the intended market, desired diamond characteristics, available capital, operational expertise, and long-term strategic goals of the manufacturing enterprise.

V. Establishing a Manufacturing Facility: Machinery and Equipment

The establishment of a synthetic diamond manufacturing facility necessitates a significant investment in a range of specialized machinery and ancillary equipment. The core production technology (HPHT or CVD) dictates the primary machinery, but a complete operation also requires equipment for pre-processing, post-processing, and rigorous quality control.

A. Core Production Machinery

- HPHT Presses: These are the workhorses for HPHT synthesis, designed to create and sustain the extreme pressures and temperatures required for diamond growth.

- Types: The most common type is the cubic press, which utilizes multiple anvils (typically six) to apply uniform pressure to the growth cell.32 Other types includebelt presses, which use two large anvils and are suited for high-volume operations, and toroidal (or Paris-Edinburgh) presses, which offer uniform pressure distribution and are versatile for research and varied shapes/sizes.43

- Components: Critical components of HPHT presses include anvils, dies, punches, and cubes, which are typically fabricated from highly durable materials like tungsten carbide or specialized silicon diamond composites to withstand the operational stresses.43

- Indicative Costs: The cost of HPHT presses varies widely based on size, capacity, manufacturer, and level of automation. For example, Labrilliante lists various models of cubic presses with prices ranging from approximately $165,000 to over $454,000.40 Listings on platforms like Made-in-China show a broad spectrum, from relatively low costs for individual components or smaller machines to $150,000 per set from some manufacturers (e.g., Guilin Guide Superhard) and potentially up to $950,000 per piece for very large or advanced systems.44

- Suppliers: Globally, companies like Hyperion Materials & Technologies supply critical components such as anvils and dies.43 Chinese manufacturers are prominent in the HPHT press market, reflecting the country's large-scale production.7 Some Indian suppliers may also offer HPHT machinery or components, though this area is less detailed in the provided information compared to CVD equipment.

- CVD Reactors: For CVD synthesis, specialized reactors, most commonly Microwave Plasma CVD (MPCVD) systems, are required.

- Components: A typical CVD reactor includes a vacuum chamber to maintain a controlled low-pressure environment, a sophisticated gas handling system for precise delivery of precursor gases (methane, hydrogen, etc.), a microwave generator and plasma source to energize the gases, temperature and pressure control systems, and a heated substrate holder for the diamond seeds.19

- Indicative Costs: CVD reactor costs are also highly variable. Laboratory-scale systems intended for research or small-scale production can range from $50,000 to $200,000. Mid-range industrial systems, offering better control and capacity, typically cost between $500,000 and $1.5 million. High-end, large-scale industrial CVD systems with advanced automation and monitoring features can cost from $2 million to $5 million or more.41 One listing on Alibaba indicated a CVD machine price between $158,000 and $178,000, likely for a smaller industrial or advanced lab model.46

- Suppliers: International suppliers include Seki Diamond Systems (known for MP-CVD systems) and Blue Wave Semiconductor (offering Hot Filament CVD systems).45 Kindle-Tech also references 915MHz MPCVD systems suitable for large-area growth.41 In India, particularly in manufacturing hubs like Surat, several companies such as Sparrow Technology, Cvl Innovation Private Limited, and Elite Techno System offer CVD diamond making machines. Diamond Tech India in Mumbai is another listed supplier.47

B. Ancillary and Post-Processing Equipment

Beyond the core synthesis reactors, a functional manufacturing line requires additional equipment:

- Laser Cutting/Sawing Machines: Essential for precisely cutting the rough synthetic diamonds from the growth substrate, separating individual crystals, removing seed material, or for initial pre-forming of the stones to maximize yield and prepare them for faceting.42 STPL Lasers are mentioned as complementary to CVD systems.45

- Grinding and Polishing Machines: These are crucial for transforming rough diamonds into finished gems with desired facets, brilliance, and polish, or for shaping industrial diamonds to exact specifications.37 Specialized machines may be needed for polishing the very hard diamond material. For instance, Shubham Technology in India offers machines specifically for polishing CVD diamond seeds.48

- Cleaning Equipment: Various cleaning stations and equipment (e.g., ultrasonic cleaners, chemical baths) are needed to remove any residues, graphite, or contaminants from the diamonds after growth or during various stages of processing.

C. Quality Control and Testing Equipment

Rigorous quality control is vital throughout the manufacturing process and for final product grading.

- Advanced Analytical Instruments:

- Spectrometers (e.g., Raman, FTIR, UV-Vis-NIR): Used to identify the chemical composition, confirm diamond structure, detect impurities (like nitrogen or boron), and differentiate between diamond types (e.g., Type IIa).49

- Photoluminescence (PL) Systems: Help to reveal growth patterns, stress, and certain types of defects or impurities that can affect clarity and color.49

- Scanning Electron Microscopes (SEM): Provide high-magnification imaging of the diamond's surface to detect minute flaws, inclusions, or structural details not visible with optical microscopy.49

- Optical Inspection Tools: Standard gemological microscopes and loupes are indispensable for manual expert inspection of clarity, color, cut precision, and any internal or external features.49

- Diamond Grading Tools: A suite of standard equipment used by gemological laboratories for accurately assessing the "4Cs" (Carat weight, Color, Clarity, and Cut quality) of gem-diamonds.19 This includes precision scales, color comparison sets, and specialized lighting environments.

The investment in machinery extends beyond the initial purchase price of the core reactor or press. A significant portion of capital expenditure and ongoing operational complexity is associated with these ancillary and post-processing machines, as well as advanced quality control instrumentation. For example, while a state-of-the-art CVD reactor is a major investment 41, its output cannot be efficiently transformed into marketable products without equally sophisticated laser cutting and polishing capabilities.37 Furthermore, robust QC equipment 49 is not merely an expense but a fundamental necessity for ensuring product quality, maintaining consistency, and supporting research and development efforts crucial for staying competitive. These "downstream" and supportive costs can be substantial and are critical for the overall operational viability and success of the manufacturing venture.

The availability and nature of the supplier ecosystem also play a crucial role. While core synthesis technology might be sourced from specialized global manufacturers (e.g., Seki Diamond for CVD systems 45, or established international HPHT press makers), the presence of a local or regional ecosystem for ancillary machinery, spare parts, and technical support services can significantly impact operational efficiency and minimize downtime. For instance, in a diamond manufacturing hub like Surat, India, local suppliers for cutting and polishing machines 47 and potentially for components or services related to core machinery offer a distinct advantage for an Indian-based manufacturer. This can reduce logistical complexities and potentially lower operational costs compared to relying solely on international suppliers for all needs. The strategic decision to source equipment locally versus globally for different categories of machinery is therefore an important consideration.

The wide variation in equipment costs, such as CVD systems ranging from laboratory-scale units around $50,000 to multi-million dollar industrial installations 41, suggests that a phased approach to investment and operational scaling might be feasible. A new entrant does not necessarily have to commence operations with a massive, fully automated facility. It could be possible to start with a smaller, perhaps more manually intensive setup, or even focus on a specific niche within the production chain (e.g., specializing only in diamond growth, with cutting and polishing outsourced) to test the market, refine processes, and build expertise. As revenue streams develop and operational capabilities mature, further investment can be made in more advanced, higher-capacity, or more automated machinery. This modularity in investment can help de-risk the substantial initial capital outlay typically associated with synthetic diamond manufacturing.

Table 4: Indicative Costs for Key Synthetic Diamond Manufacturing Equipment

Note: Prices are highly indicative and can vary significantly based on specifications, manufacturer, region, and included services.

VI. Human Capital Requirements

The successful operation of a synthetic diamond manufacturing facility is heavily reliant on a skilled and specialized workforce. The technological complexity of both HPHT and CVD processes, along with the precision required in post-processing and quality control, necessitates a team with diverse expertise.

A. Key Personnel Roles and Responsibilities

A typical synthetic diamond manufacturing plant would require personnel in the following key roles:

- Process Engineers/Scientists (Material Scientists, Physicists, Chemists): These individuals are central to the core manufacturing process. They are responsible for developing, optimizing, and meticulously overseeing the diamond growth recipes and parameters for either HPHT or CVD synthesis. Their work includes troubleshooting growth issues, improving crystal quality and yield, and conducting research and development for new diamond materials, specific properties (e.g., for electronic applications), or unique gemological characteristics.21

- Equipment Operators/Technicians: Skilled operators are needed to run the sophisticated HPHT presses or CVD reactors. Their responsibilities include loading raw materials, initiating and monitoring growth cycles, making real-time adjustments to process parameters based on sensor data, and ensuring the machinery operates within safe limits. They also perform routine maintenance.21

- Tooling Specialists (primarily for HPHT): In HPHT operations, specialists are required for the design, fabrication, precise assembly, and maintenance of critical press components such as anvils, dies, and growth cells. The longevity and performance of these tools are vital for consistent production.21

- Mechanical and Electrical Engineers: A team of engineers is necessary for the installation, regular maintenance, and troubleshooting of the complex machinery. This includes expertise in high-pressure hydraulic systems (for HPHT), vacuum systems, high-frequency microwave generators (for CVD), high-voltage power supplies, and intricate control systems.21

- Quality Control (QC) Specialists/Gemologists: This team is responsible for ensuring the quality of diamonds at various stages. Their tasks include inspecting incoming raw materials (especially diamond seeds), monitoring in-process parameters, conducting detailed analysis of grown crystals, and grading finished diamonds according to established standards (such as the 4Cs for gemstones). They operate advanced analytical equipment like spectrometers and microscopes.21

- Cutting and Polishing Technicians: Transforming rough synthetic diamonds into marketable gems or precisely dimensioned industrial parts requires skilled artisans or technicians. They operate laser cutting/sawing machines for initial shaping and precision grinding and polishing equipment to achieve the desired facets, finish, and optical performance.37

- Research and Development (R&D) Personnel: To maintain a competitive edge, a dedicated R&D team may be necessary for continuous process improvement, developing new types of diamonds (e.g., with specific doping for semiconductor applications, or novel colors for jewelry), and exploring new applications for synthetic diamond materials.12

- Supply Chain and Logistics Personnel: This function manages the procurement of all raw materials (graphite, gases, seeds, catalysts), spare parts for machinery, and oversees the packaging and shipment of finished diamond products.21

- System Administrators/IT Specialists: Modern manufacturing relies heavily on computerized control systems, data acquisition, and network infrastructure. IT personnel are needed to manage these systems, ensure data integrity, and provide general IT support.21

- Health, Safety, and Environmental (HSE) Officers: Given the use of high pressures, high temperatures, high voltages, and various chemicals and gases, HSE officers are crucial for developing and enforcing safety protocols, ensuring compliance with occupational health regulations, and managing environmental permits and waste disposal.20

- Management and Administration: This includes roles such as Plant Manager, Production Manager, Finance and Accounting staff, Human Resources personnel, and potentially Sales and Marketing teams, depending on the business model (e.g., selling rough diamonds vs. finished jewelry).21

B. Skill Sets and Expertise Needed

The required workforce must possess a range of specialized skills, including:

- A profound understanding of materials science, crystallography, solid-state physics, high-pressure physics (for HPHT), plasma physics, and vacuum technology (for CVD), and gas chemistry.

- Operational expertise in handling and maintaining sophisticated, often custom-built, manufacturing equipment.

- Precision mechanical skills for tooling, assembly, and the delicate processes of diamond cutting and polishing.

- Strong analytical and problem-solving skills for quality control, process optimization, and research and development.

- For gem applications, gemological knowledge and grading skills are essential.

- A thorough understanding of and adherence to safety protocols relevant to high-pressure systems, high-voltage equipment, and the handling of potentially hazardous gases and chemicals.

The highly specialized knowledge required, particularly in areas like high-pressure physics, plasma chemistry, and advanced crystallography, means that scientists and engineers with the requisite expertise may not be readily available in all regions. This potential talent scarcity could lead to higher compensation costs and necessitate significant investment in recruitment, retention, and extensive training programs. Collaboration with academic institutions or the development of in-house apprenticeship and advanced training schemes might be necessary to build and maintain a competent technical workforce.

C. Indicative Team Structure

The size and structure of the team will vary significantly based on the scale of operation, the chosen technology (HPHT or CVD), the level of automation, and the scope of activities (e.g., growth only versus full processing to polished gems).

- One study analyzing labor input for an HPHT synthesis operation (producing approximately 23-46 carats of near-colorless diamonds per week from a cubic press) detailed a team of 32 individuals. This included 5 operators, 5 engineer-technologists, 5 chemists, 7 tooling specialists, along with various other engineering, support, and managerial roles.21 This example suggests a more comprehensive structure suitable for a larger industrial-scale HPHT setup.

- In contrast, the same study described a team for a 2.45-GHz Microwave Plasma CVD reactor (with a capacity of about 7 carats of near-colorless, single-crystal diamonds per week) as comprising only 6 people: 4 operators, 1 senior grower (acting as head of the laboratory), and 1 administrator responsible for supply and external operations.21 This smaller team structure implies that in smaller or start-up CVD operations, personnel are likely to be multi-skilled, covering a broader range of responsibilities. For instance, a "senior grower" in such a setup might be involved in process development, equipment maintenance, and quality control—tasks that would be handled by distinct specialists in a larger facility. This has implications for recruitment strategies, favoring versatile individuals, and for the organizational design of the core team in a new venture.

As manufacturing technology continues to advance 18, increased automation in diamond growth, cutting, polishing, and even grading could shift the future labor structure. While the number of direct manual operators might decrease, the demand for more highly skilled technicians capable of programming, managing, and maintaining these complex automated systems, along with data analysts to interpret the vast amounts of process data, is likely to increase. This evolving landscape impacts long-term human resource planning and training requirements.

Table 5: Essential Personnel for a Synthetic Diamond Manufacturing Plant (Indicative)

This table outlines core technical and managerial roles. Additional staff in administration, finance, logistics, and sales/marketing would be required depending on the scale and business model.

VII. Raw Materials and Supply Chain

The consistent availability of high-quality raw materials is fundamental to the successful and efficient production of synthetic diamonds. The specific materials required differ significantly between the HPHT and CVD manufacturing processes.

A. Key Raw Materials

- For HPHT Synthesis:

- Carbon Source: The primary input is a source of carbon, most commonly high-purity graphite powder. The purity and morphology of the graphite can influence the growth process and the quality of the resulting diamonds.22

- Diamond Seed Crystals: Small, high-quality single diamond crystals are essential to initiate and template the diamond growth. These seeds can be derived from natural diamonds or, more commonly, from previously synthesized diamonds. The orientation and quality of the seed crystal are critical for achieving desired crystal growth and minimizing defects.22

- Metal Catalysts/Solvents: A metallic medium is used to dissolve the carbon source and facilitate its transport to the seed crystal under lower pressure and temperature conditions than would be required for direct graphite-to-diamond conversion. Common catalysts include iron (Fe), nickel (Ni), cobalt (Co), and their alloys.22 The composition of the catalyst can affect the growth rate and the color of the diamonds produced.

- For CVD Synthesis:

- Diamond Seed Substrates: CVD growth requires thin, flat slices of high-quality single-crystal diamond, typically with a specific crystallographic orientation. These substrates act as the surface upon which new diamond layers are epitaxially grown.22 The quality of these seed substrates (surface polish, defect density) is paramount for producing high-quality CVD diamonds.

- Process Gases:

- Carbon Source Gas: The most widely used carbon-bearing gas is methane (CH4). Its molecules are dissociated in the plasma to provide the carbon atoms for diamond growth.22

- Diluent/Etching Gas: Hydrogen (H2) is the primary accompanying gas, typically used in much larger proportions than methane (often 90-99% of the gas mixture 39). Hydrogen plays multiple roles: it helps to stabilize the diamond-growing surface, selectively etches away any non-diamond carbon (graphitic) phases that may form, and participates in the chemical reactions that generate reactive carbon species.22

- Other Gases: Small amounts of other gases, such as oxygen (O2) or argon (Ar), may be introduced for specific process control, to influence growth rates, or for doping the diamond (e.g., with boron for electronic applications).The purity of these gases is of utmost importance in CVD synthesis. Even trace impurities in the methane or hydrogen can be incorporated into the growing diamond lattice, leading to undesirable coloration, reduced clarity, or altered physical properties. This necessitates the use of ultra-high purity (UHP) grade gases and stringent gas handling and delivery systems to prevent contamination, adding to both operational complexity and cost.

B. Sourcing and Potential Suppliers (with a focus on India where applicable)

The supply chain for these raw materials involves various considerations:

- Diamond Seeds/Substrates:

- These are highly specialized materials. They can be purchased from commercial suppliers who specialize in producing diamond seeds/substrates, or a manufacturing company might choose to develop an in-house capability to produce its own seeds from larger grown crystals, which requires additional equipment and expertise.

- Indian Suppliers: In India, companies like Shubham Technology, located in Surat, offer CVD diamond seeds and also machinery for polishing these seeds.48 Nex Carbon Technologies, also in Surat, is listed as a supplier of lab-grown CVD diamond seeds in various sizes.52 Globally, Excellent Diamond Products (EDP) is mentioned as a supplier of single-crystal diamond seeds and substrates, often in conjunction with CVD equipment providers like Seki Diamond Systems.45

- The quality, size, and crystallographic orientation of diamond seeds are critical factors that act as either a yield multiplier or a significant bottleneck in both HPHT and CVD processes. Sub-optimal seeds inevitably lead to lower yields, poorer quality diamonds, and extended growth times because the seed acts as the fundamental template for all subsequent crystal growth.29 Any defects or misorientations present in the seed crystal can propagate throughout the newly grown diamond. Consequently, securing a consistent and reliable supply of high-quality seeds is a critical operational imperative that directly impacts cost-efficiency and the marketability of the final product. The Indian government's strategic focus on bolstering domestic diamond seed production, including the removal of import duties on seeds 10, clearly underscores the pivotal importance of this particular input material to the LGD industry.

- Graphite (for HPHT): High-purity graphite powder is an industrial commodity. Suppliers can be found globally through industrial chemical distributors and specialized graphite producers. For diamond synthesis, the purity and particle size distribution of the graphite are important. While specific Indian suppliers for diamond-grade graphite were not extensively detailed in the provided materials, general industrial chemical suppliers in India would be the initial point of contact.

- Methane (CH4) and Hydrogen (H2) (for CVD):

- These are standard industrial gases, but for CVD diamond synthesis, very high purity levels (e.g., 99.999% or higher) are typically required.

- Indian Suppliers of Methane: Several industrial gas suppliers operate in India. Axcel Gases is noted as a manufacturer, supplier, and exporter of methane gas in India.53 Other listed suppliers include Pratham Industries, Harsh Gas Agency, Siddi Vinayaka Industrial Gases Pvt Ltd, HindAir Products Private Limited, and Madhuraj Industrial Gases Pvt Ltd.53 These companies generally supply gases in cylinders or via bulk delivery systems and can often provide certificates of analysis for purity. Hydrogen would typically be available from the same range of industrial gas suppliers.

- Metal Catalysts (for HPHT): High-purity forms of iron, nickel, cobalt, and their alloys can be sourced from specialized metal suppliers, chemical companies, or powder metallurgy specialists. The form (e.g., powder, pre-alloyed discs) and purity are key specifications.

While some raw materials like industrial-grade graphite or standard purity industrial gases are widely available, more specialized items such as large, high-quality single-crystal diamond seeds/substrates or highly specific metal catalyst compositions might have a more limited supplier base. This can create potential vulnerabilities in the supply chain. Manufacturers need to conduct a thorough assessment of their complete bill of materials. For example, while methane gas might be readily sourced from multiple suppliers in India 53, if a particular HPHT process relies on a unique catalyst alloy available only from a single overseas source, this introduces a significant supply risk. Strategies to mitigate such risks include qualifying multiple suppliers, establishing long-term agreements, or, for the most critical inputs, developing in-house production capabilities (e.g., for seed preparation or catalyst formulation). This ensures greater control and resilience for long-term operational stability.

Table 6: Overview of Key Raw Materials for Synthetic Diamond Production

Careful selection and management of raw material suppliers, with a strong emphasis on quality and consistency, are vital for efficient and profitable synthetic diamond manufacturing.

VIII. Regulatory and Compliance Framework

The synthetic diamond industry operates within an evolving regulatory landscape aimed primarily at ensuring consumer protection, market transparency, and fair trade practices. Compliance with these regulations is mandatory and crucial for establishing a legitimate and trustworthy manufacturing operation. Key regulatory aspects span international guidelines, national laws (with a specific focus on India), and general manufacturing compliance requirements.

A. International Guidelines (Focus on US FTC)

The U.S. Federal Trade Commission (FTC) provides influential guidance for the advertising and sale of diamonds, including laboratory-grown diamonds, through its Jewelry Guides. The 2018 update to these guides brought significant clarifications:

- Definition of a Diamond: The FTC revised its definition of a diamond to: "A diamond is a mineral consisting essentially of pure carbon crystallized in the isometric system".55 Crucially, the word "natural" was removed from this primary definition, thereby acknowledging that lab-grown diamonds, which share the same chemical and physical properties, are indeed diamonds.

- Terminology and Disclosure: Sellers are mandated to clearly and conspicuously disclose that diamonds are laboratory-created or laboratory-grown to avoid misleading consumers.27 Acceptable qualifying terms include "laboratory-grown," "laboratory-created," or "[manufacturer name]-created".55 The term "cultured" is permissible if the product has the same optical, physical, and chemical properties as mined diamonds and the term is clearly qualified (e.g., "laboratory-cultured").56

- Use of "Synthetic": While marketers can still use the term "synthetic" to describe lab-grown diamonds, the FTC no longer suggests it as a primary recommended descriptor. This is partly because "synthetic" can be confusing to consumers and may not accurately describe the growth process (which is actual crystal growth, not synthesis from different components in the way some other synthetic gems are made).55 Importantly, "synthetic" cannot be used to imply that lab-grown diamonds are not "real" diamonds.55

- Prohibited Terms for LGDs (Unqualified): Marketers are prohibited from using terms like "real," "genuine," "natural," or "precious" to describe a lab-grown diamond without clear qualification that it is laboratory-created.55

- Distinction from Simulants: Materials like cubic zirconia (zirconium dioxide) or moissanite (silicon carbide), which only look like diamonds but do not share their chemical composition, must be clearly distinguished and cannot be called "lab-grown diamonds" or "diamonds".55

The overarching goal of these FTC guidelines is to ensure consumer protection through transparency, preventing deceptive marketing practices and enabling consumers to make informed purchasing decisions.26 These regulations emphasize that while lab-grown diamonds are chemically and physically diamonds, their origin must be unambiguously communicated. This regulatory push for clarity, while vital for consumer trust, also institutionally differentiates LGDs from natural diamonds, potentially reinforcing a distinct market category. This means LGD manufacturers cannot simply leverage traditional natural diamond marketing; they must build value based on their product's specific attributes within the framework of these disclosure rules.

B. Indian Regulatory Landscape

India, as a major player in both diamond processing and emerging LGD manufacturing, has its own set of regulations and standards:

- Bureau of Indian Standards (BIS):

- The BIS standard IS 15766:2007 stipulates that the term "diamond" when used alone must exclusively refer to natural diamonds. Any diamond produced by artificial means must be explicitly described as a "synthetic diamond," regardless of the production method or material used.28

- BIS also requires separate certification codes for lab-grown and mined diamonds to maintain clarity in identification and trade.27

- Crucially, the grading of synthetic diamonds alongside natural diamonds is prohibited under BIS guidelines, ensuring that consumers are not confused by comparable grading reports for products of different origins.28

- Central Consumer Protection Authority (CCPA):

- The CCPA is actively engaged in ensuring standardized terminology and adequate disclosure practices within the diamond sector to prevent consumer confusion and misleading marketing, particularly concerning the differentiation between natural and lab-grown diamonds.28

- It reinforces the guidelines set by BIS and provisions of the Consumer Protection Act, 2019, which prohibits misleading descriptions or omissions that could confuse consumers.28

- Recent consultations have led to proposed comprehensive guidelines that would mandate: explicit labeling and certification of all diamonds specifying their origin (natural or lab-grown) and production method; a prohibition on using misleading terms like "natural" or "genuine" for lab-grown products; and the establishment of accreditation systems to regulate and standardize diamond testing laboratories.28

- Central Board of Indirect Taxes & Customs (CBIC):

- Effective from October 30, 2024, CBIC Notification No. 21/2024 mandates the explicit declaration during customs procedures of whether a diamond is natural or lab-grown. If lab-grown, the production method (e.g., CVD, HPHT, or others) must also be specified. This measure aims to enhance transparency and accountability in the diamond trade.27

- The Harmonized System (HS) Codes are critical for customs classification. Synthetic worked diamonds fall under heading 7104 (specifically 7104.20 for polished synthetic diamonds), distinguishing them from natural diamonds (HS code starting 7102). Correct HS code usage is essential for the accurate application of customs duties and Goods and Services Tax (GST), and misclassification can lead to financial penalties and trade disruptions.59

- Import/Export Policies and Investment:

- To boost domestic LGD manufacturing, the Indian government has reduced the import duty on LGD seeds to zero (from 5%) until March 2026.10

- The government has also permitted 100% Foreign Direct Investment (FDI) in the LGD sector under the automatic route, meaning foreign investors or Indian companies do not require prior government or RBI approval for such investments.10 This dual approach of regulatory strengthening for consumer protection alongside policy support for manufacturing indicates a strategic intent by India to become a major, yet responsible, LGD hub. For manufacturers, this translates to potential incentives and a growing ecosystem, but also a stringent compliance environment.

- Factory Licenses and Environmental Compliance (General for Manufacturing in India):

- Any manufacturing unit in India, including a synthetic diamond facility, must obtain a Factory License from the local municipal or state factory inspectorate, ensuring compliance with safety, health, and welfare standards under the Factories Act.20

- Pollution Control Clearance (Consent to Establish and Consent to Operate) from the relevant State Pollution Control Board (SPCB) is mandatory. This involves adherence to regulations concerning air emissions, water discharge, and waste management.20 Given that LGD production involves high energy consumption and the use of chemicals and gases, managing environmental impact will be a key compliance area.15

- A Hazardous Chemicals License may be required if the quantities and types of chemicals used (e.g., solvents, catalysts, cleaning agents, compressed gases) meet certain thresholds.20 The Maharashtra Factories Rules, 1963, for instance, define a "Hazardous Factory" based on the processes and substances handled.51

- A Fire Safety Certificate from the local fire authorities is also necessary to ensure the facility meets fire prevention and safety standards.20

- Documentation for factory registration typically includes details of raw materials, intermediate products, by-products, finished products, quantities, handling methods, Material Safety Data Sheets (MSDS) for hazardous chemicals, process flow diagrams, and the company's health and safety policy.51

While current regulations emphasize disclosure and consumer protection, the environmental aspects of LGD production—particularly energy consumption 23, water usage 15, and chemical waste management 15—represent an area that could face increased regulatory scrutiny in the future. This is especially relevant as "sustainability" is a core marketing tenet for LGDs. Manufacturers who proactively adopt and can verifiably demonstrate genuinely sustainable practices (such as utilizing renewable energy sources, implementing closed-loop water systems, and ensuring responsible chemical handling and disposal) may not only gain a competitive market advantage but also be better prepared for potentially more stringent environmental regulations beyond basic factory permits.

Table 7: Key Regulatory Requirements for Synthetic Diamond Manufacturing

Compliance with this multifaceted regulatory framework is non-negotiable and fundamental to the long-term viability and reputation of a synthetic diamond manufacturing business.

IX. Initial Investment Considerations and Financial Outlook

Establishing a synthetic diamond manufacturing operation is a capital-intensive venture, requiring significant upfront investment in specialized technology and infrastructure, as well as careful management of ongoing operational costs. Understanding these financial aspects is crucial for assessing the viability and potential profitability of such an enterprise.

A. Overview of Major Capital Expenditures (CapEx)

The primary capital outlays for setting up a synthetic diamond manufacturing facility include:

- Machinery & Equipment: This constitutes the largest portion of the initial investment.

- Core Synthesis Equipment: The cost of HPHT presses or CVD reactors can range from approximately $250,000 to $2 million for initial setups, depending on the scale and sophistication.13 High-end industrial CVD systems capable of large-volume, high-quality production can cost upwards of $2 million to $5 million or more.41

- Ancillary Equipment: Significant additional investment is required for laser cutting and sawing machines, precision grinding and polishing equipment, and comprehensive cleaning systems.

- Quality Control Equipment: Advanced analytical instruments like spectrometers, photoluminescence systems, SEMs, and standard gemological testing tools also represent a substantial CapEx component.

- Infrastructure:

- Facility: Costs associated with acquiring land and constructing a suitable building, or leasing and renovating an existing industrial space. This includes setting up specialized areas like clean rooms (particularly critical for CVD processes to prevent contamination), and ensuring robust foundations for heavy machinery.13

- Utilities: Installation of high-capacity electrical systems to power energy-intensive equipment, sophisticated cooling systems (chillers, water circulation), compressed air systems, and specialized gas delivery lines for CVD reactors.13

- The initial investment in combined equipment and infrastructure for a start-up could range broadly from $500,000 to $3 million, and potentially much higher for larger-scale operations.13

- Licenses and Permits: Fees associated with obtaining the necessary factory licenses, environmental clearances, and other regulatory approvals required to operate legally.14

- Initial Raw Material Inventory: Stocking up on initial supplies of diamond seeds/substrates, high-purity graphite, process gases, metal catalysts, and other consumables.14

B. Key Operational Cost Factors (OpEx)

Ongoing operational expenses significantly impact profitability:

- Raw Materials: Continuous procurement of diamond seeds, graphite, high-purity gases (methane, hydrogen), and metal catalysts. The cost and quality of these materials are critical.14

- Energy: This is a major and recurring operational cost, particularly for the energy-intensive HPHT process and the plasma generation in CVD reactors.14 The choice of electricity tariff and energy source (renewable vs. fossil fuel) will heavily influence this cost component and also has sustainability implications. Energy costs are a strategic factor; securing low-cost, preferably renewable, energy can provide a dual advantage of reduced OpEx and a more credible sustainability narrative, which is a key LGD selling point.3

- Labor: Salaries and benefits for a specialized workforce, including scientists, engineers, skilled technicians, equipment operators, gemologists, and administrative staff.13 Given the specialized skills required, labor costs can be substantial.

- Maintenance & Consumables: Regular maintenance of sophisticated machinery, replacement of worn parts (e.g., anvils in HPHT presses, components in CVD reactors), and replenishment of consumables like catalysts, crucibles, and polishing materials.

- Marketing and Branding: For businesses targeting the jewelry market, significant ongoing investment in marketing, branding, and consumer education is essential to build brand recognition, differentiate products, and drive sales. This can account for 10-20% of total business expenses.13

- Certification Costs: Fees paid to independent gemological laboratories (e.g., GIA, IGI) for grading and certifying gem-quality diamonds. This is crucial for market acceptance and commanding appropriate prices.27

- Inventory Management: Costs associated with holding and managing an inventory of rough and polished diamonds, including insurance and security, especially if the business model includes direct-to-consumer sales.13 The risk of inventory devaluation due to falling market prices for LGDs is a significant concern.9 Holding large inventories in such a market can erode profit margins or lead to losses if prices drop before sale, and may also complicate financing options if inventory is used as collateral.13 This necessitates agile inventory management and careful market forecasting.

C. Factors Influencing Profitability and Return on Investment (ROI)

The financial success of a synthetic diamond manufacturing venture hinges on several interconnected factors:

- Market Prices of LGDs: The revenue per carat is directly tied to prevailing market prices, which have shown volatility and a general downward trend due to increasing supply and competition.9 This puts pressure on manufacturers to manage costs effectively.

- Production Efficiency & Yield: Optimizing growth cycles to maximize the output of high-quality rough diamonds, minimizing defects and crystal imperfections, and achieving high yields in the cutting and polishing stages are critical for profitability.

- Cost of Production: Vigilant management of all operational costs—particularly energy, raw materials, and labor—is essential to maintain healthy margins in a competitive market.

- Scale of Operation: Larger production volumes can lead to economies of scale, reducing the per-unit cost of diamonds and improving overall profitability.13

- Product Mix & Value Addition: Focusing on higher-value segments within the LGD market can enhance profitability. This could include producing larger carat sizes, fancy colored diamonds, diamonds with exceptional clarity, or specialized industrial diamonds with unique properties tailored for high-tech applications.

- Brand Strength & Market Positioning: A strong brand identity, particularly in the jewelry segment, can command premium pricing, foster customer loyalty, and ensure more stable demand even in a competitive market.24

- Sales Volume: Given that LGDs typically have a lower retail price point than natural diamonds, achieving comparable overall profit levels often requires significantly higher sales volumes.13 While LGDs may offer higher percentage gross margins (e.g., 60-65% for LGDs versus 40-45% for natural diamonds as cited in one source 13), the lower absolute price per stone means the absolute profit per unit is less. For example, a 60% margin on a $1,500 LGD yields $900 gross profit, whereas a 40% margin on a comparable natural diamond priced at $4,875 yields $1,950.13 This disparity illustrates that LGD manufacturers and retailers often need to adopt a business model focused on higher sales volumes and extreme operational efficiency, shifting from a traditional luxury scarcity model to one of accessible scale.

Table 8: Indicative Initial Investment Breakdown for a Mid-Scale LGD Facility (CVD Focus, Gem-Quality)

Note: These figures are highly indicative and intended to provide a general sense of scale. Actual costs will vary significantly based on the specific project scope, location, technology choices, level of automation, and supplier negotiations.

X. Key Success Factors and Strategic Recommendations

Navigating the complexities of the synthetic diamond manufacturing industry requires a strategic approach focused on several key areas. Success is not guaranteed solely by market entry; it demands continuous innovation, operational efficiency, astute market positioning, and adaptability.

A. Technology Selection and Innovation

The foundational decision of choosing between HPHT and CVD technology must align with the company's target market (gem-quality vs. industrial, specific colors or clarities), available capital, and in-house technical expertise. Beyond the initial choice, a commitment to ongoing research and development is paramount. This R&D should aim to continuously improve diamond quality, enhance production efficiency, reduce operational costs, and explore the development of novel diamond applications or unique characteristics (e.g., diamonds with specific electronic properties, new fancy colors for jewelry, or optimized abrasive materials).12 Technological leadership or fast adoption of emerging innovations can provide a significant competitive advantage.

B. Operational Excellence and Cost Management

Given the price-competitive nature of the LGD market, particularly for gem-quality stones, operational excellence is non-negotiable. Implementing lean manufacturing principles to maximize yield from rough crystals and minimize material waste during all processing stages is crucial. Securing stable, long-term, and cost-effective supplies of high-quality raw materials—especially diamond seeds/substrates and high-purity gases—is vital. Furthermore, a relentless focus on energy efficiency, particularly if employing the HPHT method or if sustainability is a core component of the brand's identity, can significantly impact the bottom line and enhance market credibility.

C. Market Positioning and Branding

A clear and differentiated market position supported by strong branding is essential, especially in the crowded jewelry segment. Manufacturers must develop a unique selling proposition (USP) that resonates with their target audience.14

- For jewelry applications, this often involves emphasizing ethical sourcing, environmental sustainability (backed by verifiable practices), affordability relative to natural diamonds, and appealing designs. Effective branding is critical to stand out and build consumer trust and preference.24

- For industrial applications, the focus should be on consistently delivering diamonds with tailored properties that meet specific technical requirements, ensuring reliability of supply, and offering competitive pricing for bulk orders.In all segments, absolute transparency in labeling and marketing, clearly distinguishing lab-grown diamonds from natural diamonds and accurately representing production methods, is crucial for building long-term consumer trust and ensuring compliance with regulatory standards.27 As prices for some LGDs trend towards commoditization, particularly at the lower end of the jewelry market, building intrinsic value beyond simply being a less expensive alternative to natural diamonds becomes critical. This involves creating desire for LGDs in their own right through superior design, association with influential designers or personalities 4, unique colors or properties achievable specifically through lab growth, or compelling brand narratives centered on innovation, modern luxury, and responsible manufacturing.

D. Supply Chain Management

Developing robust and resilient supply chains for all critical raw materials is a key operational imperative. This is particularly true for specialized inputs like high-quality diamond seeds/substrates and ultra-high-purity process gases, where supplier options may be limited. Exploring local sourcing opportunities, where feasible (for example, in established diamond hubs like India), can help reduce logistical costs, shorten lead times, and enhance supply chain security.

E. Talent Acquisition and Development

The sophisticated nature of synthetic diamond manufacturing demands a highly skilled workforce. Actively recruiting, training, and retaining scientists, engineers, and technicians with expertise in materials science, physics, chemistry, and precision manufacturing is fundamental. Continuous investment in employee training and development is also necessary to keep the workforce abreast of rapid technological advancements and evolving best practices in the industry.

F. Navigating Regulatory Landscape

Strict adherence to all international and national regulations concerning the labeling, disclosure, safety standards, and environmental impact of synthetic diamond production is mandatory. Manufacturers must stay proactively informed about the evolving regulatory landscape in their target markets and production locations to ensure ongoing compliance and avoid legal and reputational risks.24

G. Financial Prudence

A meticulously developed financial plan, featuring realistic projections for capital expenditures, operational costs, revenue streams, and profitability, is essential. Given the observed price volatility in the LGD market, implementing strategies to manage this risk, such as agile inventory management and flexible pricing models, is crucial for financial stability.13

H. Strategic Recommendations

Based on the analysis, the following strategic recommendations are proposed:

- For a New Entrant in India:

- Leverage National Advantages: Capitalize on supportive government policies such as the zero import duty on LGD seeds 11 and the 100% FDI allowance.10 Tap into the established diamond cutting, polishing, and trading ecosystem in hubs like Surat and Mumbai 10, which can provide access to skilled labor and ancillary services.

- Technology Focus: Consider prioritizing Chemical Vapor Deposition (CVD) technology for gem-quality diamond production. This aligns with current market trends showing strong growth in CVD-produced gems 3 and India's existing strengths in diamond processing.

- Sustainability as a Differentiator: Proactively invest in and showcase the use of renewable energy sources for manufacturing. This will bolster sustainability claims, a key marketing point for LGDs, and differentiate the brand in a market increasingly scrutinized for its actual environmental footprint.

- For Targeting Industrial Markets:

- Technology Choice: High-Pressure/High-Temperature (HPHT) synthesis may offer a more cost-effective route for producing industrial abrasives, diamond grit, or specific grades of polycrystalline diamond (PCD) tools.