Marketplace for medical devices isn't just growing, it's exploding!

Healthcare procurement market evolution & growth best of tech & patient needs met to create a billion dollar industry.

The healthcare industry is undergoing a significant digital transformation, with e-commerce emerging as a powerful channel for the distribution of medical devices, equipment, and machines. This shift is not merely a convenience; it represents a multi-billion dollar opportunity driven by evolving patient needs, technological advancements, and a growing demand for efficiency and accessibility in healthcare procurement

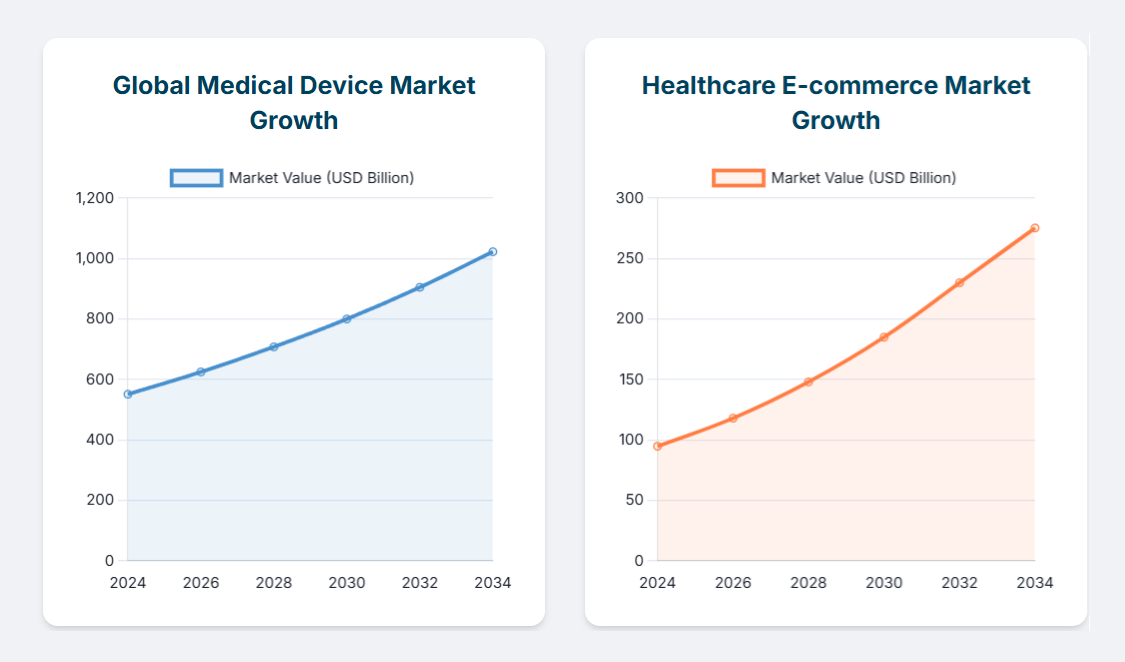

Market Size and Growth Projections

The global medical device market is a substantial and continuously expanding sector.

- Overall Medical Device Market: Valued at approximately USD 551.3 billion in 2024, it is projected to reach USD 1,022.50 billion by 2034, demonstrating a robust Compound Annual Growth Rate (CAGR) of 6.34% between 2025 and 2034 [Source 6.1]

- Healthcare E-commerce Market: This broader market, which includes pharmaceuticals and medical devices, was estimated at USD 94.79 billion in 2024 and is expected to grow to USD 275.32 billion by 2034, with a CAGR of around 11.25% [Source 1.2]. Specifically, the medical devices category within healthcare e-commerce was valued at USD 15.0 billion in 2023 [Source 1.2]. Another projection estimates the global healthcare e-commerce market to reach USD 1362.15 billion by 2033, growing at a CAGR of 16.27% [Source 6.3].

- Driving Segments:

- Wearable Medical Devices: This segment alone is projected to grow from USD 39.31 billion in 2025 to USD 232.98 billion by 2035, with a staggering CAGR of 19.48% [Source 1.1]. Online channels are already a significant distribution method for these devices, reflecting consumer comfort with online purchases in healthcare.

- Home Medical Equipment: Valued at approximately USD 45 billion in 2024, this market is projected to grow at a CAGR of 4.5%, reaching USD 69 billion by 2034. Online sales contribute a significant 28% to this segment, highlighting the existing digital adoption [Source 2.1].

- Geographical Growth: North America currently holds the largest share in both the overall medical device and healthcare e-commerce markets, but Asia-Pacific is projected to exhibit the fastest growth rates [Source 6.1, 6.3]. This indicates immense untapped potential in emerging economies.

Market Available for Growth

Despite the impressive figures, a significant portion of medical device sales still heavily relies on traditional distribution models, including distributors and direct sales representatives. This presents a substantial opportunity for online marketplaces to capture market share.

- Shifting Buyer Behavior: Business-to-business (B2B) healthcare buyers are increasingly demanding online capabilities, seeking quick access to pricing, product details, stock availability, invoices, and quotes online. Research indicates that 90% of healthcare equipment buyers identify suppliers online [Source 5.2]. This demand signals a strong readiness for digital procurement solutions.

- Direct-to-Consumer (D2C) Potential: There's a "massive gap in supply and demand" for both specialized and basic medical supplies that can be partially filled by D2C online sales [Source 5.2]. Online platforms can connect manufacturers directly with end-users, reducing costs and increasing efficiency.

- Convenience and Remote Healthcare: The growing demand for convenience, time-saving solutions, and the expansion of telehealth services are accelerating the adoption of online healthcare platforms. Patients and healthcare providers are increasingly comfortable managing health through technology, driving the need for accessible online purchasing of devices for remote patient monitoring, home care, and self-diagnosis [Source 1.2, 2.1, 5.1, 6.3].

- Operational Efficiencies: Digital commerce platforms offer significant operational efficiencies by streamlining processes, enhancing customer experience, and optimizing the buying journey. This includes efficient product information management, digital asset management, personalization, and omnichannel commerce strategies [Source 5.1].

Successful Businesses and Strategies

While specific, pure-play "online marketplaces for medical devices" that have reached billion-dollar valuations are still emerging as distinct entities, several businesses within the broader healthcare e-commerce and medical device distribution space demonstrate successful online strategies:

- Soma Tech International: This company, a refurbisher and reseller of medical devices, successfully revamped its online e-commerce presence (Source 3.1). Their success factors include:

- Extensive Inventory & User Experience: Offering a wide range of products from top manufacturers with an intuitive website design.

- UX Strategy: Focusing on user journey mapping, clear website hierarchy, and a cohesive brand guide.

- Technical Implementation: Integrating robust e-commerce functionality (like WooCommerce), bilingual support, responsive design, and SEO-friendly programming to enhance visibility and ease of use (Source 3.1).

- General Strategies for Success: Companies succeeding in online medical device sales often employ these tactics:

- Strong Online Presence and Digital Marketing: Utilizing SEO, content marketing (blogs, case studies), social media, and professional, user-friendly websites to reach a wider audience and generate leads [Source 2.2, 2.3].

- Personalization and Trust: Tailoring communication, product recommendations, and services to individual customer needs. Building trust is paramount in healthcare, often achieved through transparent information, detailed product descriptions, and educational resources [Source 5.1, 5.2, 7.1, 7.2].

- Integrated Solutions: Leveraging data and analytics, and integrating with ERP (Enterprise Resource Planning) and CRM (Customer Relationship Management) systems for real-time inventory, pricing, and customer interaction management [Source 5.2].

- Focus on Value and Relationships: Moving beyond aggressive sales pitches to become a "trusted advisor," focusing on how products improve patient outcomes and reduce costs, and fostering long-term relationships through consistent follow-ups and support [Source 2.2, 7.1, 7.2].

- Amazon's Foray: Amazon's increasing involvement in healthcare e-commerce, from basic medical supply sales to long-term initiatives leveraging machine learning, signifies the potential and the attention from tech giants. Their focus on consumer trust, convenience, and efficient supply chains could set new benchmarks for the industry [Source 5.2].

Failed Businesses and Reasons for Failure

While specific "failed online medical device marketplaces" with detailed public post-mortems are not readily available in search results, we can infer common pitfalls that lead to failure in the broader medical device and e-commerce sectors, which would apply to such marketplaces:

- Regulatory Compliance and Trust: This is perhaps the biggest hurdle.

- Lack of Proper Approvals/Certifications: Medical devices are heavily regulated (e.g., FDA approvals in the US). Marketplaces must ensure that all devices listed comply with stringent regulatory standards. Failures in this area, such as the sale of "fake FDA authorizations" or unapproved devices (e.g., knockoff N95 masks that failed to filter particles), can lead to severe legal repercussions, loss of trust, and public safety issues [Source 4.3, 7.1].

- Transparency and Data: A lack of transparency on product quality, maintenance needs, and device-related data can hinder learning, device improvement, and event prevention, eroding user trust [Source 4.2].

- Quality Control and Product Reliability: While more applicable to manufacturers, an online marketplace that fails to vet its suppliers for quality control procedures, proper testing, and use of high-quality components will quickly lose credibility. The "top seven reasons why medical devices fail" include poor testing, low-quality components, and insufficient maintenance, issues that a marketplace needs to address through rigorous vendor onboarding and quality assurance processes [Source 4.1].

- Complex Sales Cycles and Relationship Building: Medical device sales often involve long, complex cycles with multiple stakeholders (doctors, hospital administrators, procurement). Online platforms might struggle to replicate the personalized, trust-based relationships traditionally built by sales reps, leading to slow adoption. Overcoming this requires building robust customer support, educational content, and possibly hybrid models that combine online access with human support [Source 7.1, 7.3].

- Logistics and Supply Chain: Managing the supply chain for diverse medical devices, many of which have specific storage, handling, and delivery requirements, can be incredibly complex. Inefficient systems, lack of real-time inventory data, or inability to handle specialized logistics can lead to delays and dissatisfaction.

- Insufficient Domain Expertise and Team: Approximately 75% of medical device companies fail or never make it to market, often due to the inability to "assemble a team of professionals to build, test, and market their devices" [Source 4.1]. An online marketplace requires a team with expertise not only in e-commerce and technology but also deep understanding of medical regulations, healthcare procurement processes, and device specificities.

- Resistance to Change: Despite the digital shift, established healthcare institutions may be slow to fully adopt new online procurement methods due to existing relationships with distributors, ingrained purchasing habits, or concerns about security and reliability.

Conclusion

The creation of an online marketplace for medical devices, equipment, and machines represents a significant, multi-billion dollar growth industry. Driven by the overall expansion of the medical device market, the rapid growth of healthcare e-commerce, and increasing demand for convenient, efficient, and remote healthcare solutions, the market is ripe for disruption.

Success in this arena hinges on a clear understanding of the unique challenges, particularly stringent regulatory compliance, the need for deep trust, complex B2B sales cycles, and specialized logistics. Marketplaces that prioritize robust quality assurance, transparent processes, exceptional customer service, and strategic digital marketing, while effectively navigating the regulatory landscape, are well-positioned to capture a substantial share of this burgeoning market. Conversely, failure to address these critical aspects, particularly around regulatory adherence and building trust, will be detrimental.