Guidelines for Preparing a Payment, Receipt, and Overhead Report.

1. General Preparation Steps

Before creating any report, follow these steps:

- Collect all transactions for the relevant period (e.g., a month).

- Organize data by columns: Date, Particulars, Cheque No (if any), Debit, Credit, Balance..

- Identify transaction types using keywords in the "Particulars" column (e.g., "TO NEFT" = payment, "BY NEFT" = receipt).

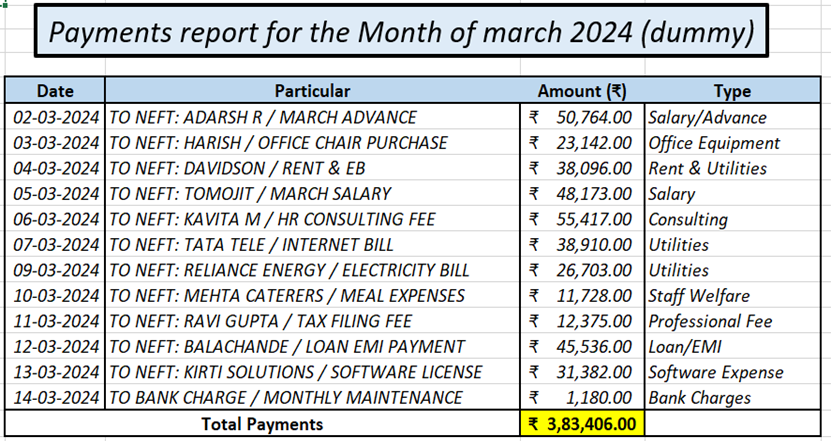

A. Payments Report

A.1. Purpose:

To track outflows of money from the account — expenses, salaries, purchases, etc.

A.2. Steps to Create:

- Filter transactions where the Debit column has an amount.

- Record:

- Date

- Particular/Payee

- Amount

- Purpose/Category

- Total all payment amounts at the bottom.

A.3. Example:

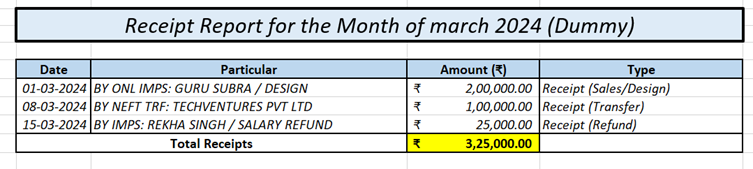

B. Receipts Report

B.1. Purpose:

To track inflows of money into the account — income, refunds, capital injections.

B.2. Steps to Create:

- Filter transactions where Credit column has an amount.

- Record:

- Date

- Source/From

- Amount

- Nature of Receipt (e.g. Sales, Refund, Capital)

- Total all receipts at the bottom.

B.3. Example:

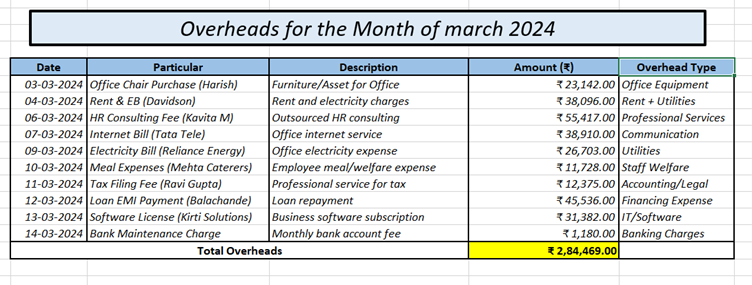

C. Overheads Report

C.1. Purpose:

To list indirect operational expenses — costs not directly tied to production but essential for running the business.

C.2. Steps to Create:

- From the Payments Report, identify non-core operational expenses such as:

- Rent

- Utilities

- Office supplies

- Professional fees

- Salaries (admin, HR)

- Software, Bank fees, Loan EMIs

- Group each payment by Overhead Category. The following are the common overhead categories.

- Rent

- Utilities

- Office supplies

- Taxes

- Depreciation on fixed assets

- Advertising expenses

- Permits and licenses

- Accounting and legal fees

- Record:

- Date

- Description

- Amount

- Overhead Type

C.3. Example:

Best Practices

- Use Excel or Google Sheets for sorting and filtering.

- Use consistent naming for categories (e.g., "Utilities", "Payroll").

- Double-check debit/credit alignment before generating the report.

- Maintain backups and create monthly folders for organized storage.